Latest News.

Structured wheat, barley and canola marketing.

All the latest news from Advantage Grain and from grain markets around the world.

June 17, 2024

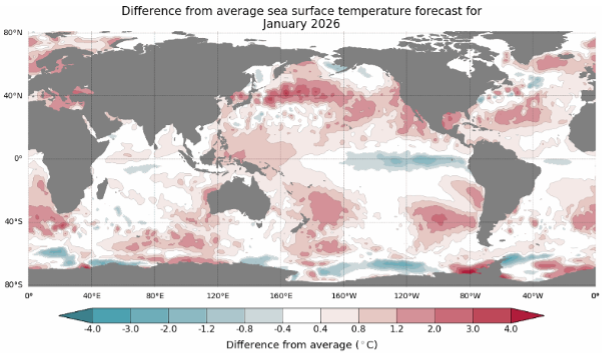

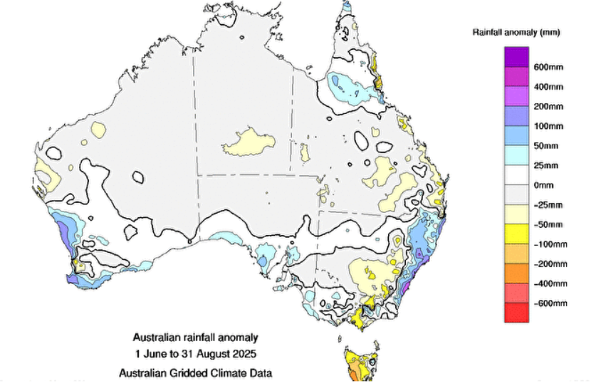

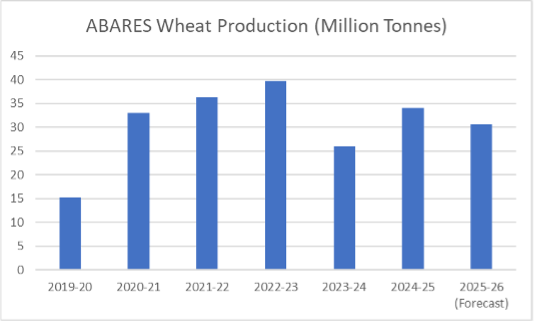

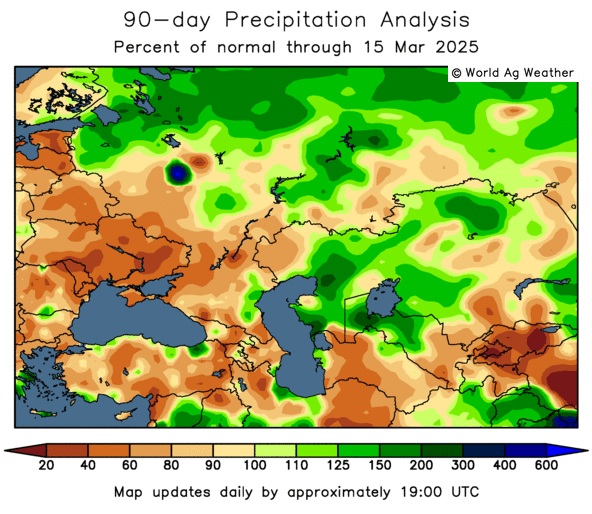

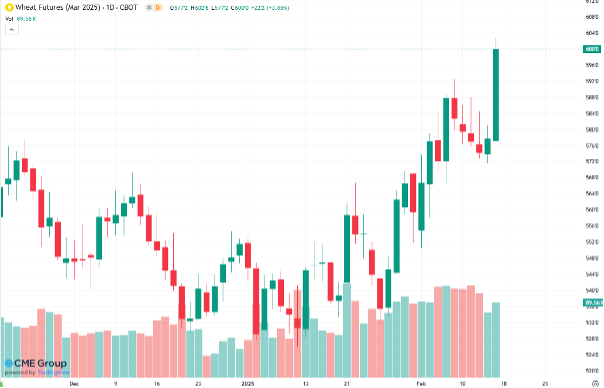

Over the last four weeks, global grain markets have featured an extreme level of volatility due to events in Russia and Turkey. Last week’s USDA update of global supply and demand statistics has confirmed the upcoming year will be globally tight due to an extremely dry spring in Russia. However, Turkish authorities took the decision to throw cold water on the global rally by announcing a wheat import ban. Closer to home, WA has received much needed rains while calls for La Nina continue but extend further into the future.

By Chris Nikolaou

•

February 16, 2024

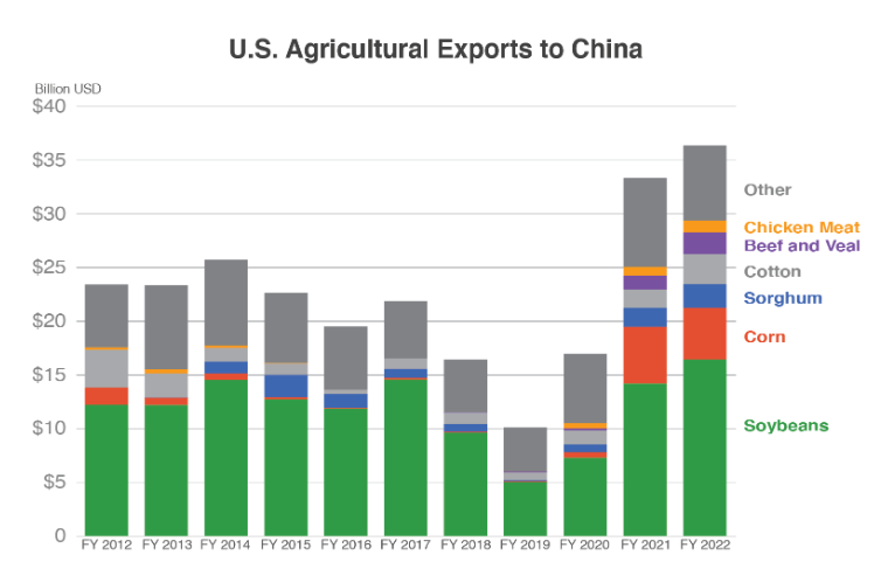

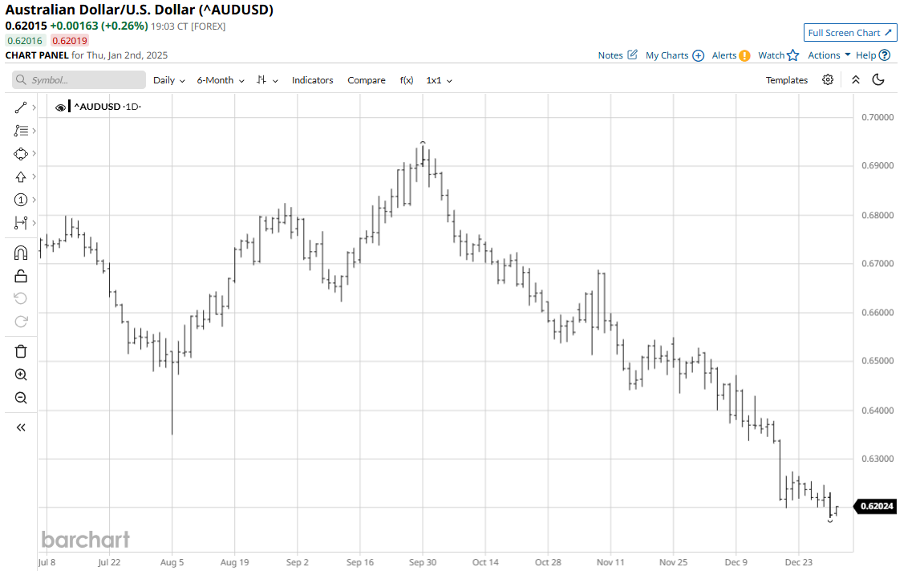

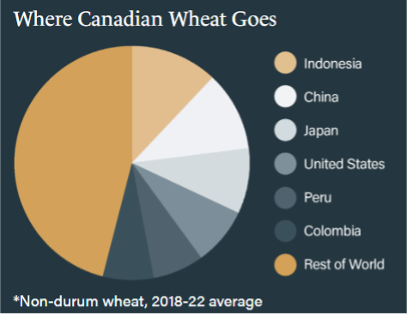

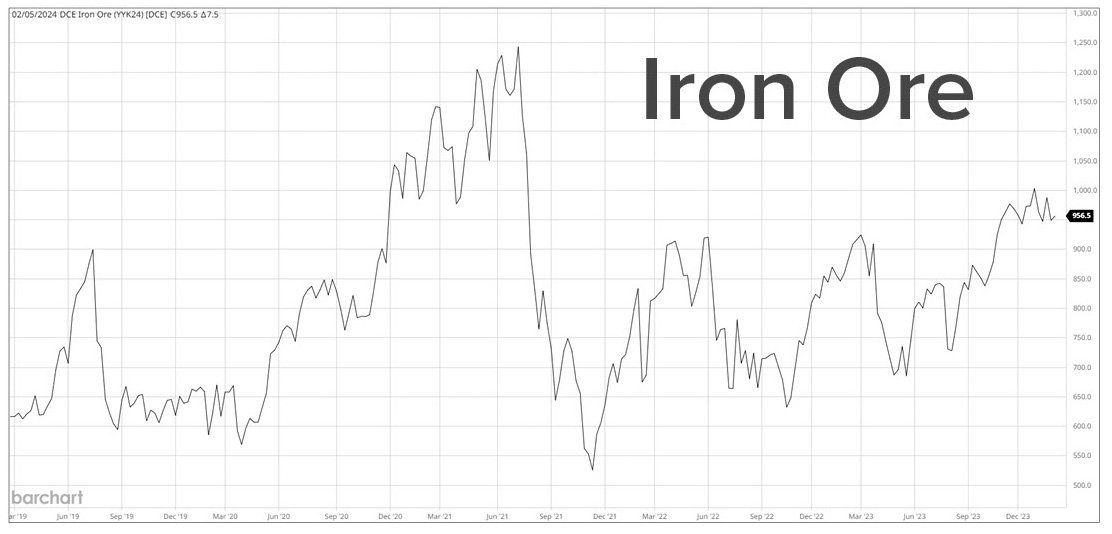

China, one of the world's powerhouse economies, has been making headlines

of late due to a pullback in its real estate and stock markets. This

economic downturn is combined with a population that has been slow to come

out of the Covid-19 lockdowns. Consequently, consumer price deflation is

creating headwinds for the persistent growth that China has experienced

over the past decades. However, amongst the economic slowdown, commodity

imports remain resilient which is positive for Australian grain growers.

By Chris Nikolaou

•

December 21, 2023

2023 has been a volatile year for commodities markets. Although the war in

the Black Sea continues, Ukrainian supply has slowly returned to the

market. This has led to an overall decline in grain prices since this time

last year. The world’s consumers have benefitted, but is the tide about to

turn? If 2023 was the year of the consumer; will 2024 be the year of the

producer?!

By Chris Nikolaou

•

November 16, 2023

The 2022/23 marketing season has now come to a close.

Overall, the Advantage structured marketing programs have performed well

through what was a volatile season. Ongoing war in the Black Sea, a tough

finish to the U.S. corn crop and poor rainfall late in the Australian

season all led to a late-season spike in local grain prices. Growers in the

Advantage 10 month program benefited from this in the September – October

pricing period.

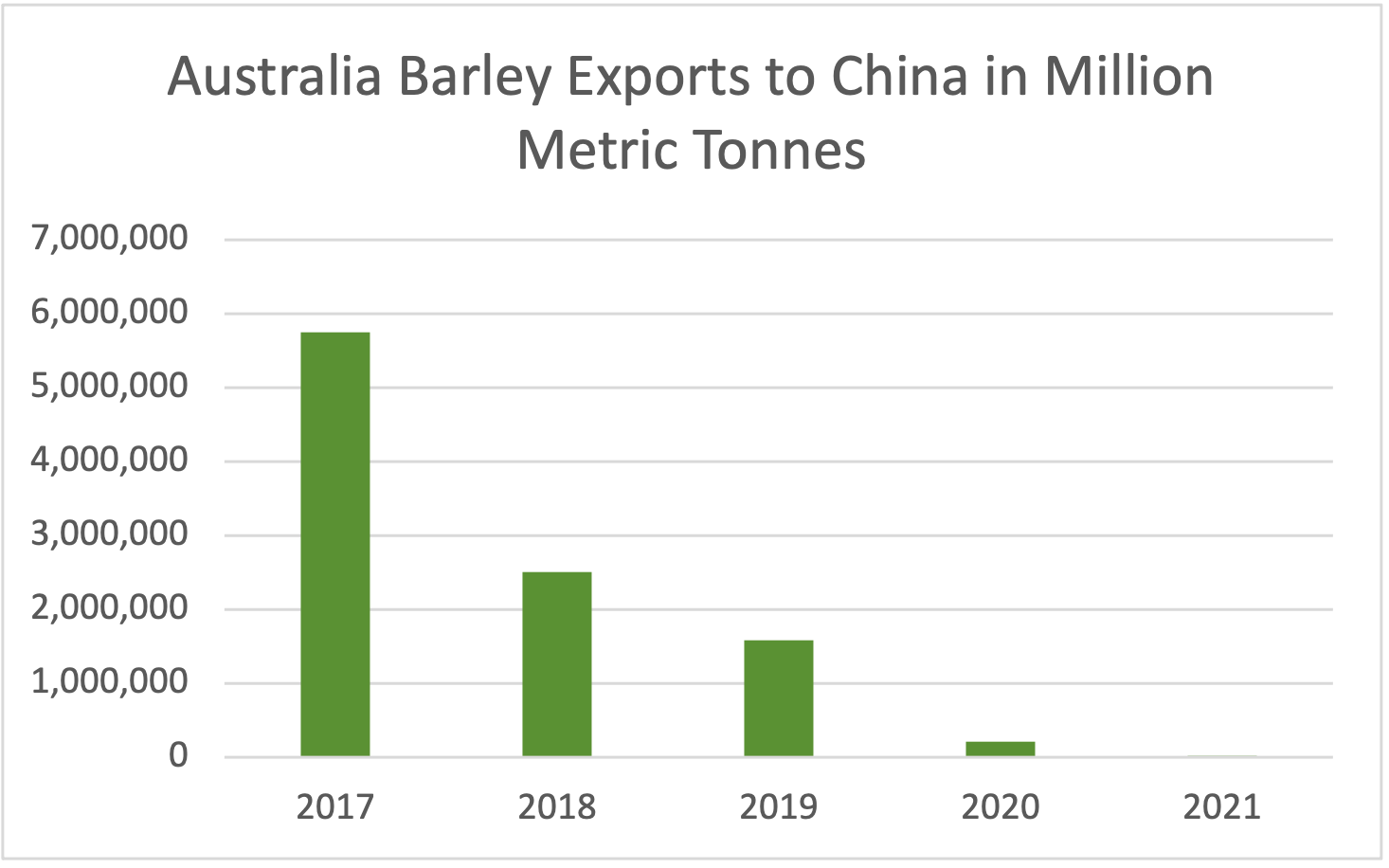

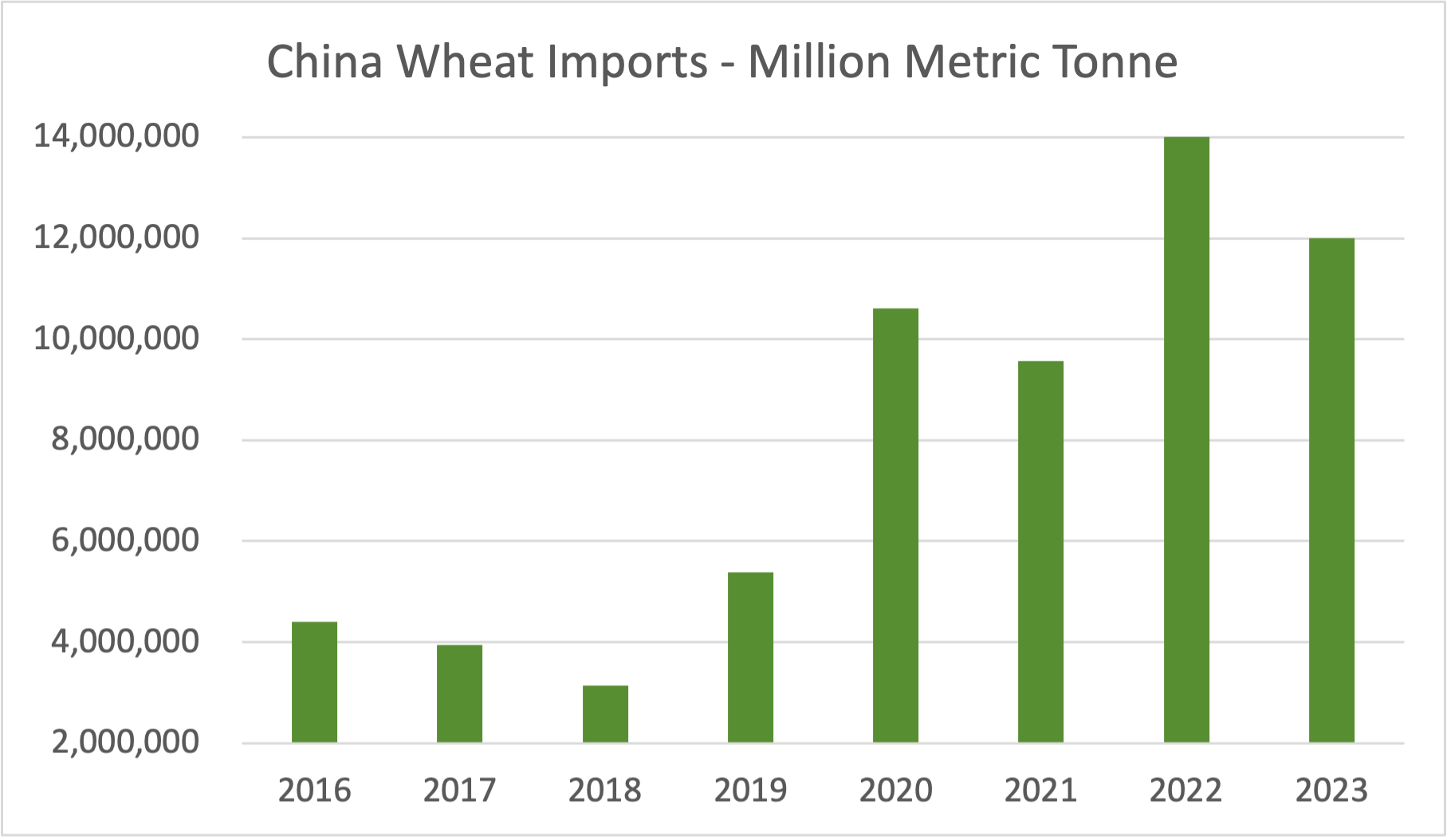

As expected, China has re-entered the market as a strong buyer of

Australian barley since the import tariffs have been lifted. China also

continues to buy Australian wheat at a pace that is not as sustainable as

the purchases during recent higher production years.

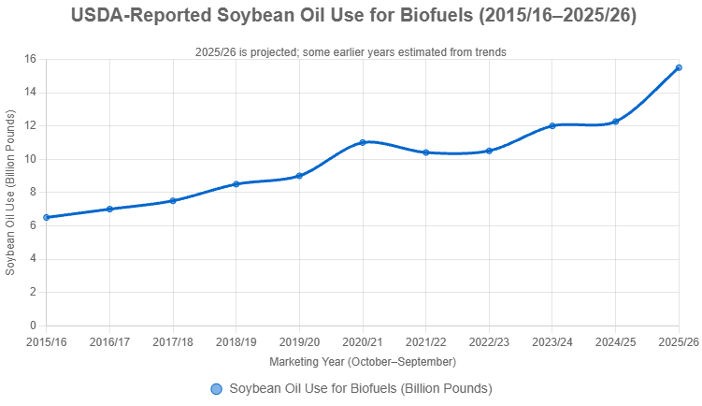

The canola market is still down from the start of the season but a recent

uptick in pricing may suggest a turnaround is on the cards for the overall

oilseeds markets.

By Chris Nikolaou

•

October 13, 2023

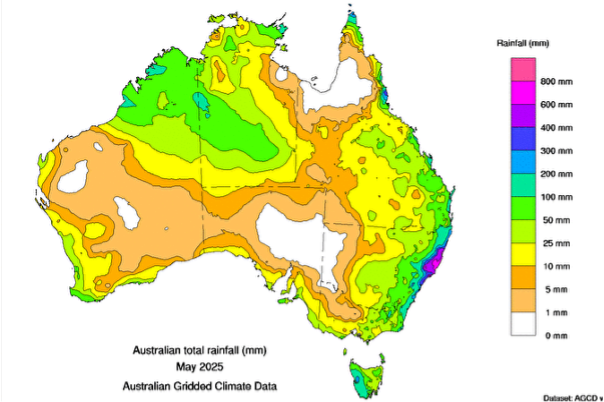

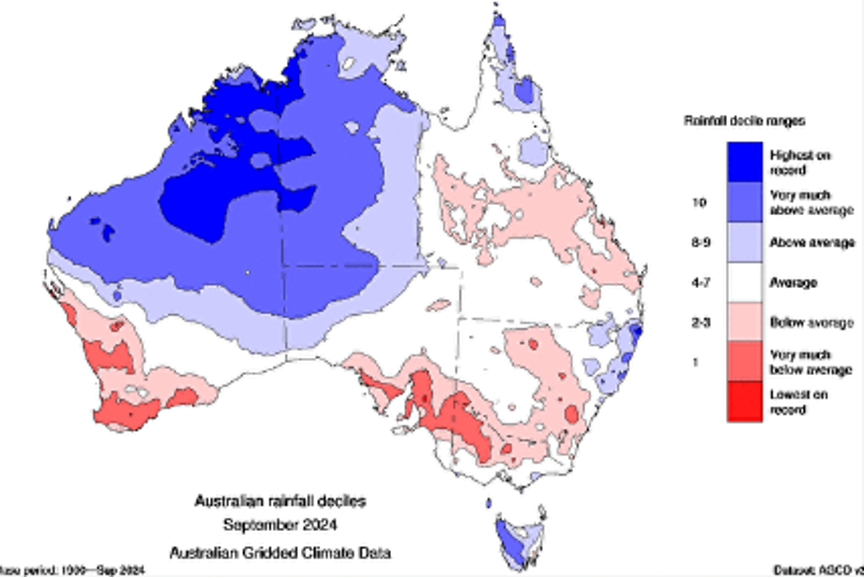

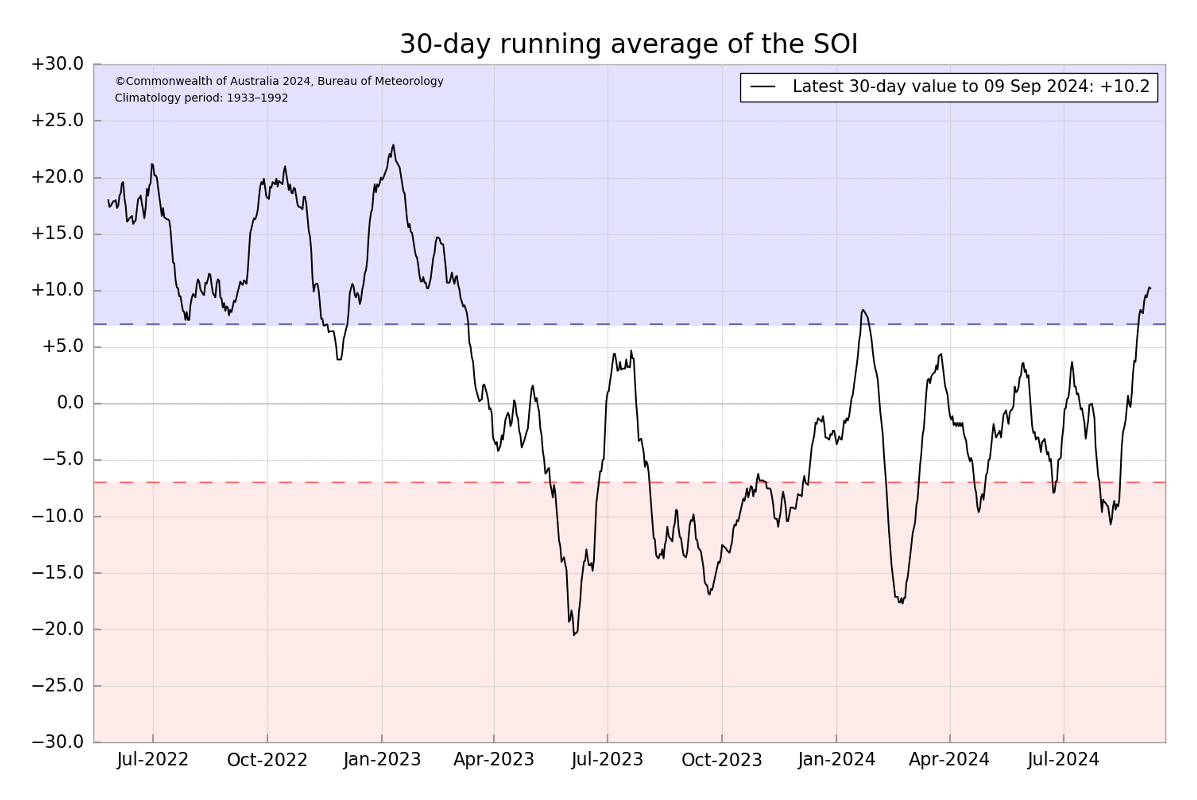

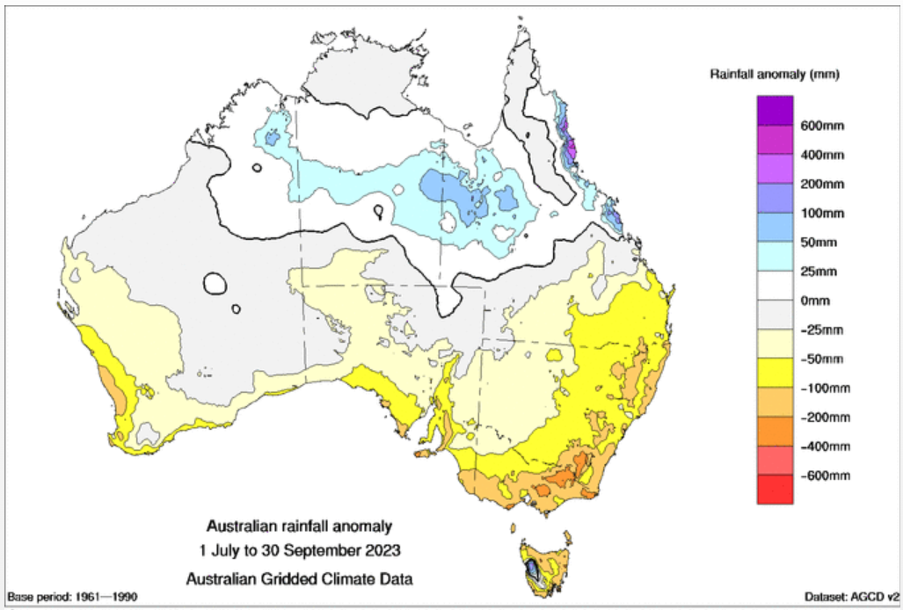

On the whole, Australia has been blessed with three strong years of grain

production from 2020 through to 2023. However, after a promising start to

the year and with many areas of the country holding good moisture profiles

after a wet summer, the last three months have turned dry. Most areas of

the national growing belt are experiencing 50+ mm deficits in rainfall for

the July to September period. Why the big change and what are the weather

patterns driving this current dry spell?

By Chris Nikolaou

•

July 14, 2023

The Black Sea conflict continues to create uncertainty in agricultural

markets as proponents of the Ukrainian food corridor look for a last-minute

agreement to extend the supply chain.

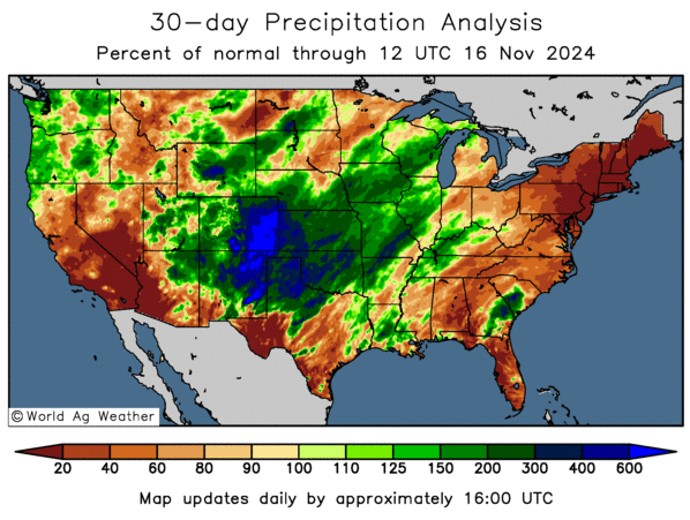

Weather challenges to the growing seasons in the United States and Canada

have increased market volatility since the start of June with canola being

the main beneficiary.

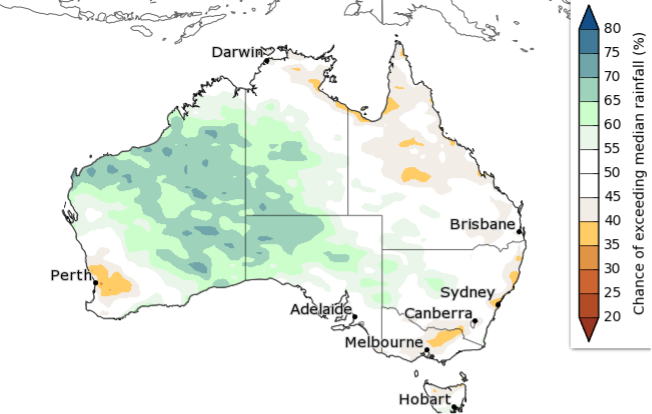

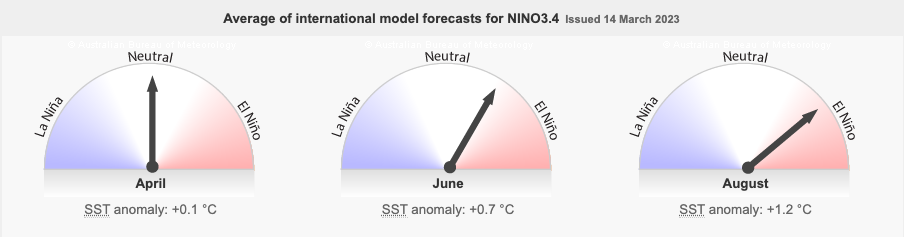

The BOM maintains a concerning outlook for winter and spring weather in

Australia.

Read the full update here!

By Chris Nikolaou

•

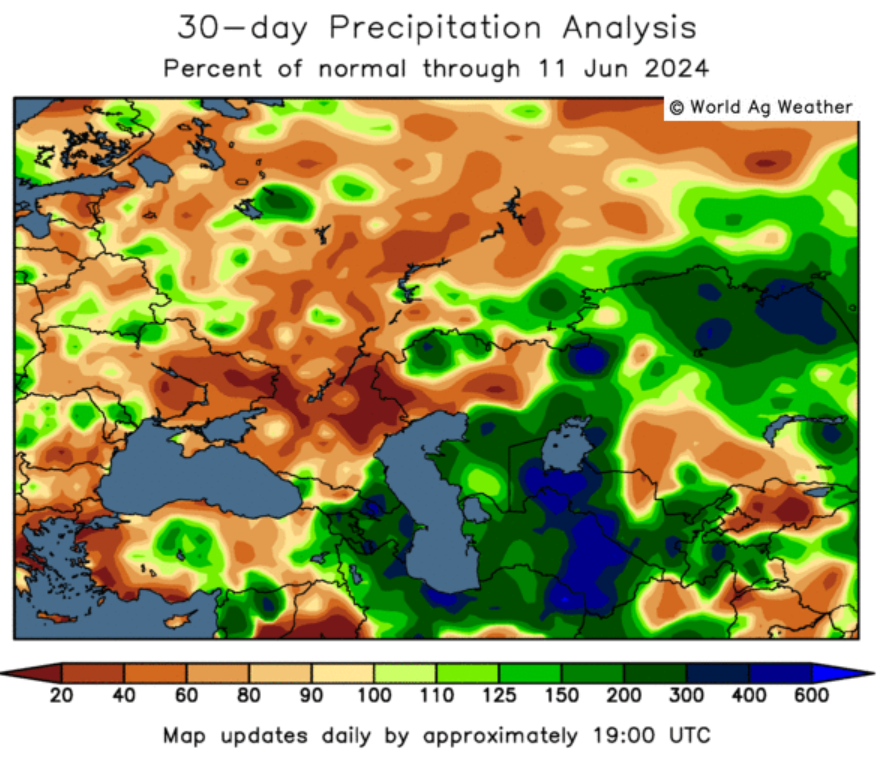

June 16, 2023

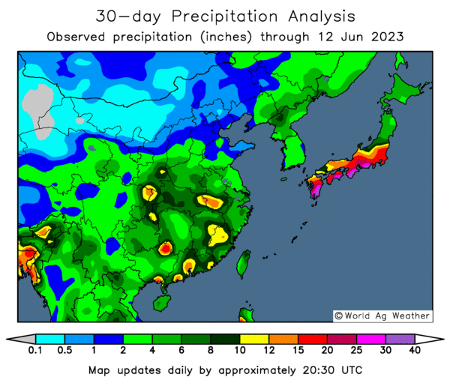

Over the last month, we have seen excessive rainfall in China in the

lead-up and during their local wheat harvest. EU winter crops and Russian

spring wheat are all experiencing a hard finish to their growing season.

Closer to home, Aussies brace for a possible impact from the El Niño alert

issued by the Bureau of Meteorology (BOM).

By Chris Nikolaou

•

June 1, 2023

Advantage Grain Pty Ltd has announced its entrance into the grain export

market, with the company’s first wheat vessel loaded and on its way to the

Middle East where it will be used for flour milling.

Advantage Grain General Manager, Chris Nikolaou said the company’s foray

into the grain export market marks a significant milestone for the company.

By Chris Nikolaou

•

May 16, 2023

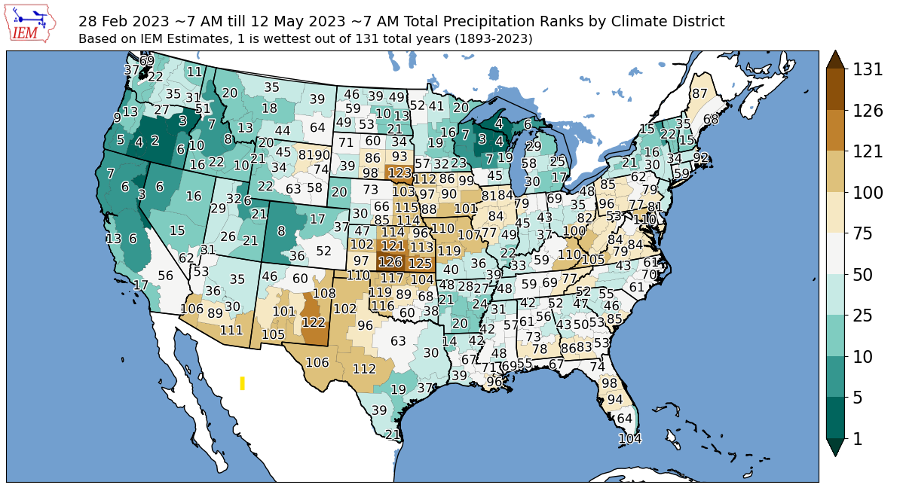

On Friday, May 12th the USDA updated the world agricultural supply and

demand tables. This included the first estimates for the 2023-24 season.

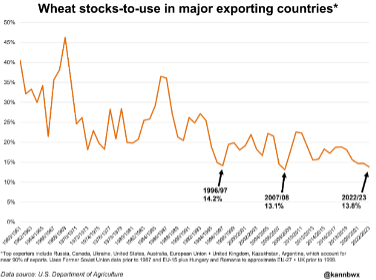

Wheat was viewed as bullish as the global carry-out is estimated to fall

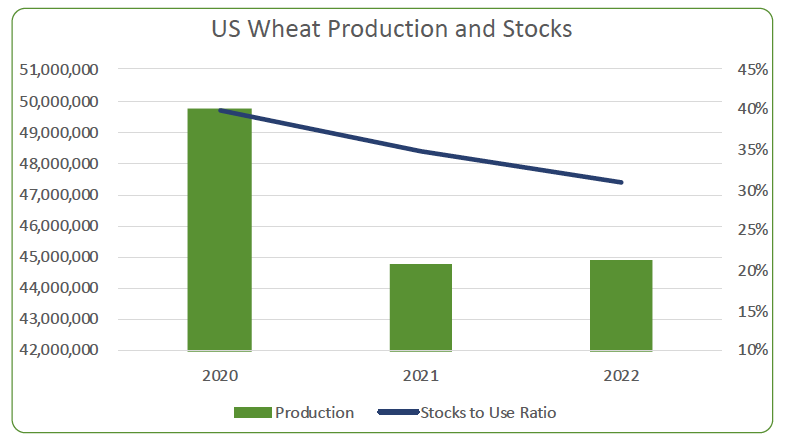

this coming year. Of note was the decline in U.S. production as drought-hit

Kansas is expected to produce the smallest crop in over 50 years. Global

production estimates all rely on weather performing over the coming months

in key production areas of Russia and Canada for wheat and the United

States for corn and soybeans. A tightening wheat balance sheet does not

leave room for any further production issues in other major exporters

By Chris Nikolaou

•

April 17, 2023

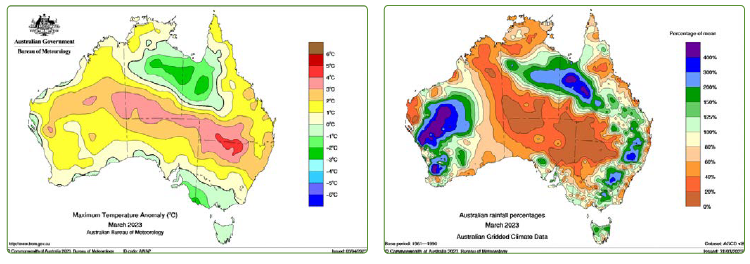

March 2023 saw continued turbulence in global commodity and capital

markets. Ongoing economic uncertainty, geopolitical tensions, and concerns

over inflation and interest rates were among the drivers of market

volatility. A steady stream of headlines relating to global weather and

crop conditions, the continuing flow of low-cost Black Sea origin grain

into the global market and light at the end of the tunnel after a three

year Australian barley export tariff into China saw agricultural markets

respond accordingly.

By Chris Nikolaou

•

March 16, 2023

Activity in grain market influences such as the global economic landscape,

domestic export pace, demand and weather, continue to dominate chatter in

the industry. However, despite the backdrop of a high interest rate,

deflationary environment and declining international grain values,

Australian grain markets have shown great resilience over the past month.

This is a credit to our record export pace, the expected change to the

2023/24 season climate outlook and increasing cattle on feed numbers as a

result of weakening livestock markets.

By Chris Nikolaou

•

February 15, 2023

Grain market volatility continues to be a defining trait of the markets.

The Ukraine conflict is ongoing with another round of food corridor

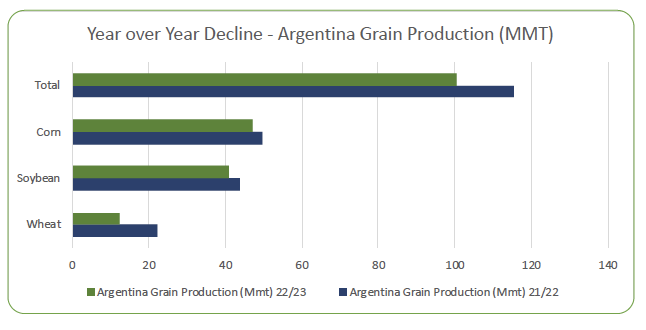

extension talks commencing. Over the last six months, drought in Argentina

has impacted their wheat and soybean crops and now threatens their corn

crop as well. On a more positive note, Australian relations with China are

improving and the industry is hopeful for a renewed barley market. Locally,

Aussie growers have managed through an extraordinary harvest with extreme

weather, a late finish and a slightly better than expected product.

By Chris Nikolaou

•

December 23, 2022

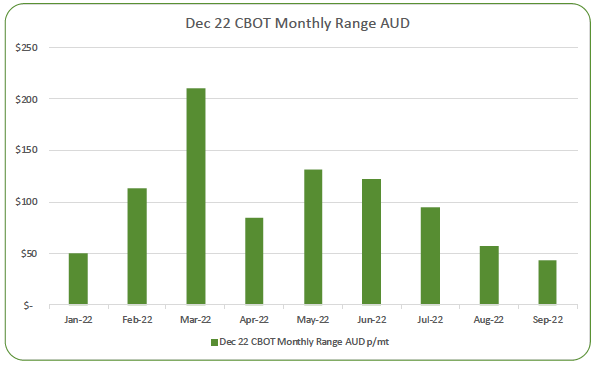

Over the course of the 2022 grain marketing year, we have seen extreme

volatility in grain markets. Grain markets exploded in March of this year

when Russian forces entered Ukraine and hostilities commenced. Three months

later, a safe grain corridor was negotiated for Ukrainian grain between the

UN, Turkey and Russia which is set to expire this month. Additionally, the

US experienced a drought that decreased their production of wheat. At home,

excessive rainfall due to a trifecta of weather patterns has had a severe

impact on crop outlooks for NSW. Throughout the 2021/22 season, Australian

grain was in high demand globally and this is expected to continue into the

2022/23 season.

By Chris Nikolaou

•

October 14, 2022

Global wheat markets have surged higher with the U.S. and Black Sea facing

production and logistics issues. The conflict in Ukraine, which appears

unable to be de-escalate along with expensive U.S. wheat, will ensure

strong demand for Australian production. At home, we’re looking at another

big winter crop, and although it looks like the La Niña weather pattern

will present challenges over harvest, all grades of Aussie wheat look like

they’re set to achieve strong values on the global market.

By Chris Nikolaou

•

September 15, 2022

What a difference a week can make! Since Russia and Ukraine signed the UN

brokered Food Export Corridor deal in July, we’ve seen reduced market

volatility compared with the first half of the year. However, last week we

saw how sensitive these markets are to possible changes in this agreement

and how world wheat supplies are still struggling without adequate

Ukrainian products. Closer to home, Australia is looking well set up to

reach a forecast production of 55MMT, the fourth largest on record, with

favourable weather set to hit key production areas during the vital spring

growing period.

By Chris Nikolaou

•

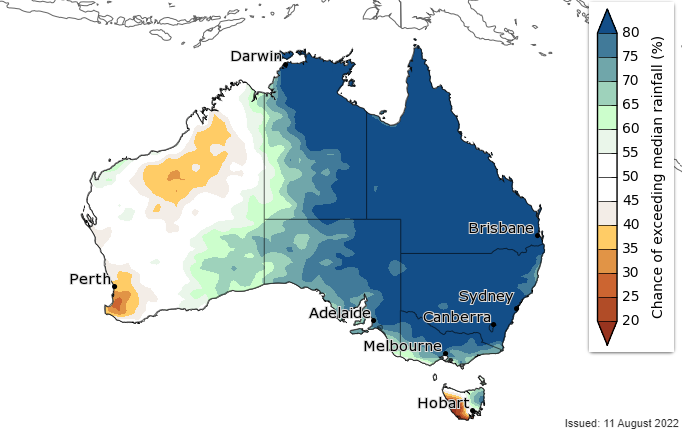

August 17, 2022

An ongoing strong La Niña has led to wetter than normal conditions in

Australia and dryer than average conditions in the United States and the

growing regions of South America. Western Europe is also struggling with

dry and hot conditions. Australian exports continue at a strong pace while

the market switches focus to the outlook for new crop locally.

By Chris Nikolaou

•

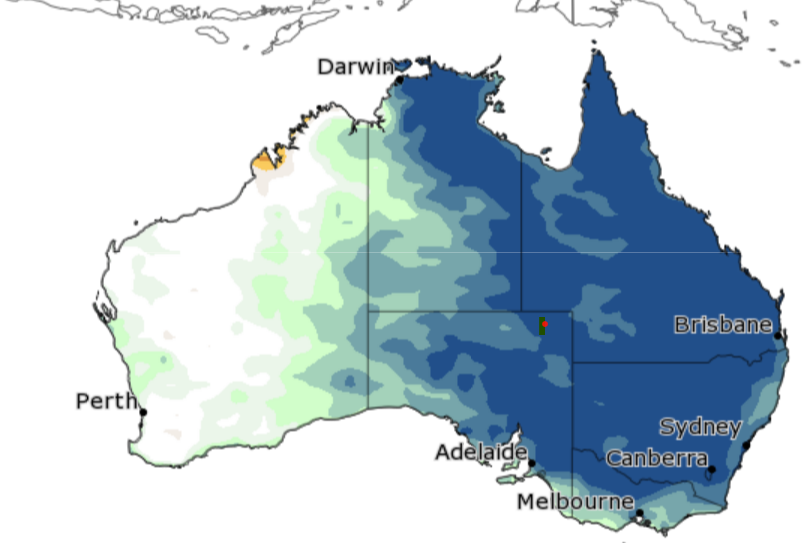

July 18, 2022

Extreme volatility continues in offshore markets as the world grapples with

the lack of Ukrainian supplies while elsewhere in the northern hemisphere,

wheat harvest is in full swing. Closer to home Australian exports for the

season continue to show good pace in spite of pandemic challenges to supply

chain and weather-related setbacks. Current outlooks for a return of La

Niña in the spring and the Indian Ocean Dipole status offer hope for a

positive year for Australian producers

By Chris Nikolaou

•

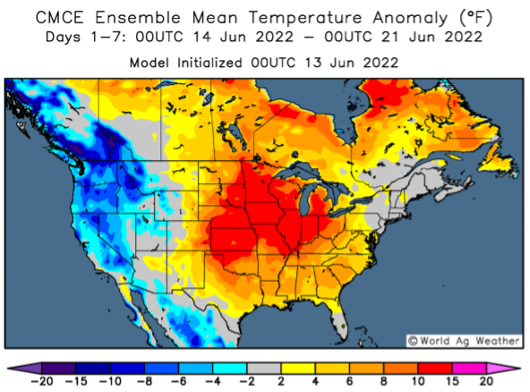

June 16, 2022

Over the course of 2022, we have witnessed extremes in grain markets.

Ongoing conflict in Ukraine has removed 75% of that nation’s grain export

capabilities. Ongoing hard seasons in North and South America have been

unable to produce large enough quantities of grain and oilseeds to repair

the world’s supply. This has created extremely volatile futures markets.

This volatility is set to continue as the U.S. enters their summer growing

season with a heat wave this week. Closer to home the BOM updated their

outlook on June 9th calling for a wetter than average winter. Although,

there are some growers who would like to see a dry spell.

By Chris Nikolaou

•

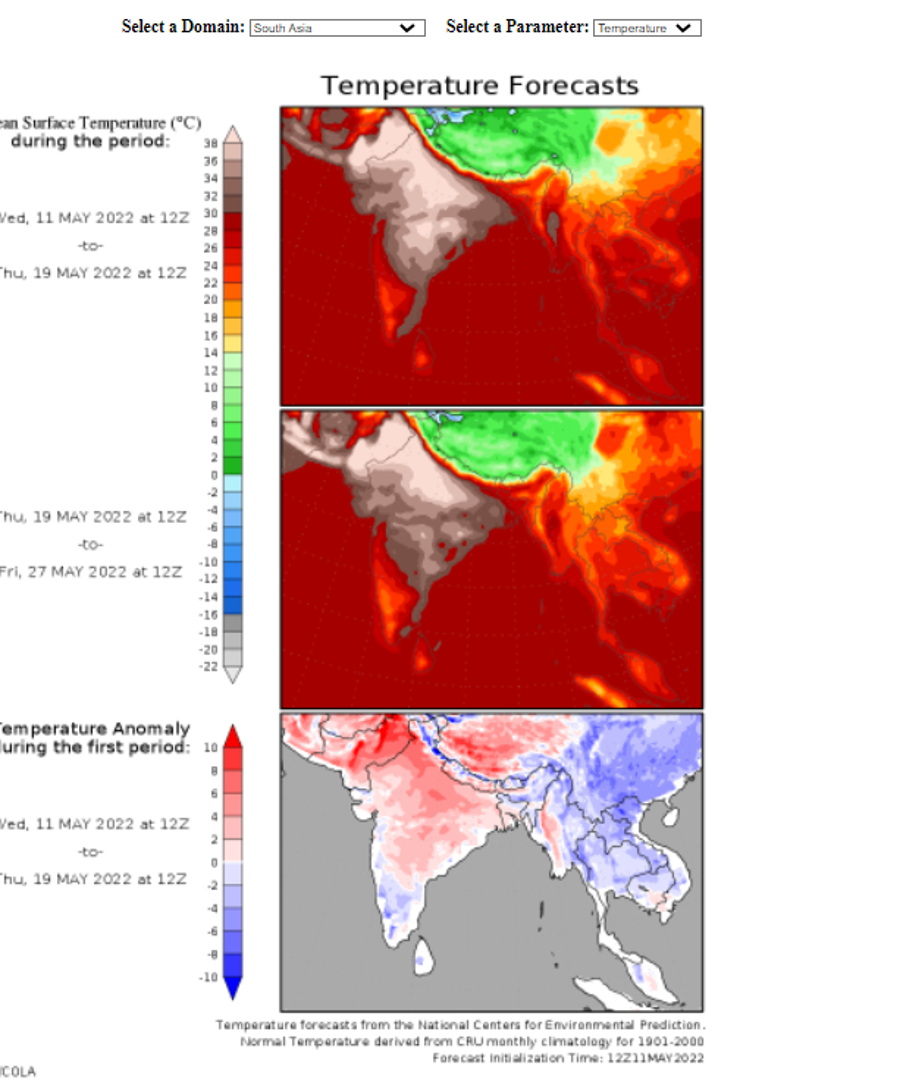

May 12, 2022

As the Black Sea conflict enters its third month, global consumers of wheat

look to other producing origins to make up for the lost Ukrainian supply.

Consequently, normal suppliers such as Australia, Europe, Argentina and

North America have seen an uptick in demand. Interestingly, India has

stepped in as an unlikely supplier to the world for its food needs.

However, this supply may be short lived. La Niña driven weather continues

to make for hard seasons in both North and South America. Australian

growers commence their growing season in largely strong conditions;

however, not all parts of the country are enjoying supportive wet weather.

By Chris Nikolaou

•

April 19, 2022

The violence in Ukraine continues to dominate global markets as both sides

settle into what could be a drawn-out conflict. Dryness in the Southern

Plaines of the United States further threatens the outlook for wheat

supplies in the 2022/23 season while India emerges as an unlikely exporter

of wheat. High commodity prices have now become a political touch stone in

both the east and the west with Sri Lankans taking to the streets to

protest lack of food and fuel availability.