Global Volatility and Positive Australian Weather Outlook

Over the course of 2022, we have witnessed extremes in grain markets. Ongoing conflict in Ukraine has removed 75% of that nation’s grain export capabilities. Ongoing hard seasons in North and South America have been unable to produce large enough quantities of grain and oilseeds to repair the world’s supply. This has created extremely volatile futures markets. This volatility is set to continue as the U.S. enters their summer growing season with a heat wave this week. Closer to home the BOM updated their outlook on June 9th calling for a wetter than average winter. Although, there are some growers who would like to see a dry spell.

Ukraine Update

It is estimated that Ukraine will finish this season with 30MMT of grain carry over as the conflict drags on and prevents exports. There are negotiations for a ‘safe grain corridor’ through the Black Sea. These are being led by Turkey. However, Russia has demanded any agreement should include lifting of sanctions. Although talks are ongoing, they do not appear to be making progress in the short term.

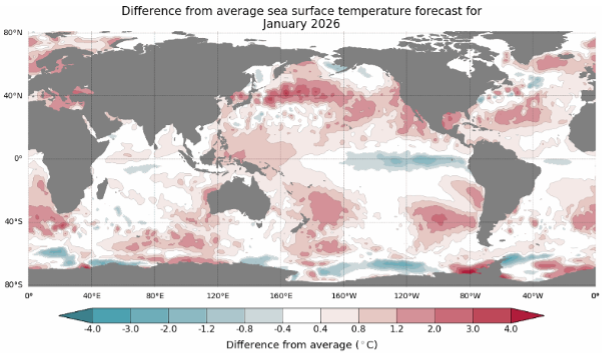

Early Heatwave for the U.S.

A widespread and early heat wave will take place through growing regions of the U.S. over the next 10 days. Temperatures are expected to be 5 – 10 degrees Celsius higher than normal. The market is hoping that the responsible ridge will shift towards the end of the month returning the Midwest growing regions to more normal temperatures.

Figure 1: worldagweather.com

BOM Update

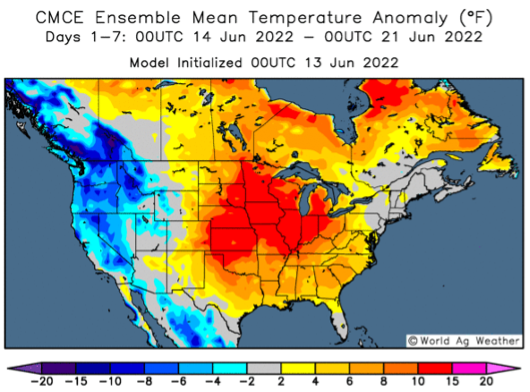

In their June 9th update, the BOM called for above median rainfall for much of Australia. There are several weather patterns driving this. A persistent La Niña continues to feed easterly weather and warm the ocean waters off the coast of Northern Australia. A negative IOD in the Indian Ocean is forecast to develop. This leads to warmer waters off the coast of Australia and cooler waters towards India. This weather pattern improves the likelihood of weather systems hitting Australia in the northwest and moving through to growing regions in the east and south.

Figure 2 bom.gov.au – 3 month rain outlook July – September

However, not all regions are currently looking for more rain. Growers from central NSW through to QLD have reported the inability to seed due to overly wet and boggy conditions. In some instances, small planes are being used to air-seed! However, the next fortnight should bring drier conditions as the BOM forecasts a dry spell before the above outlook takes shape.

We are also pleased to see that recent rainfall through South Australia and the Victorian Mallee has improved conditions slightly. We hope this pattern continues.

Overall, Australia continues to see excellent demand for grains and oilseeds as the conflict rages on in Ukraine. Market volatility is set to continue as the U.S. enters its summer growing season with unseasonably hot weather. Closer to home, the BOM is forecasting a positive season. However, this will need to verify over the coming months.