Aussie harvest rolls south while US data gap comes to an end.

Rowan Fessey, 14 November 2025

2025 -26 Harvest Progress

Harvest has kicked off across most grain-growing regions, with progress varying across the country. Queensland (QLD) and Northern New South Wales (NSW) harvest is generally on schedule to slightly ahead with the southern growing areas lagging behind with showers and cool weather slowing things down.

QLD and Northern NSW moved through the bulk of their wheat and barley programs earlier than usual thanks to a warm, dry September that accelerated maturity. Yields from these northern areas have been mixed but largely in line with grower expectations after the dry finish—wheat proteins have been strong, screenings manageable.

In Western Australia (WA), harvest has shifted into full gear after patchy showers initially delayed starts. Growers have reported variability paddock to paddock however overall, canola yields in some early-stripped paddocks have surprised on the upside, early barley yields in Geraldton and northern Kwinana are coming in positively, while early yields on wheat look good while still being a low protein ASW year.

South Australia (SA) has also begun to pick up momentum, though the state remains roughly a fortnight behind where it typically would be for mid-November. Early yields from the Upper Eyre Peninsula (EP) and Mallee districts have been modest, reflecting a dry seasonal finish and a limited soil-moisture profile heading into Spring. Better results are expected from the lower EP, Mid North and South East where crops held on slightly longer and received the late October rainfall.

Laharum Victoria

Mundulla SA

Victoria (VIC) and Southern NSW are the last major regions to get fully underway, with many growers waiting out cooler, damp conditions through the first half of November. While delays have been frustrating, the milder finish may yet help grain fill in some later-sown crops, particularly in the Wimmera and Western District.

Nationally, the theme is variability, delays and persistence! Canola oil content is holding up well and barley is indicating good malt potential in southern zones. Wheat proteins have been higher than average in the drier northern and western regions, though southern protein levels are expected to sit closer to long-term averages with the cool slower finish.

As headers continue to roll south, the market is preparing for a steady lift in supply pressure, though not being overwhelmed with tonnes due to the slower progress.

Canola harvest NSW.

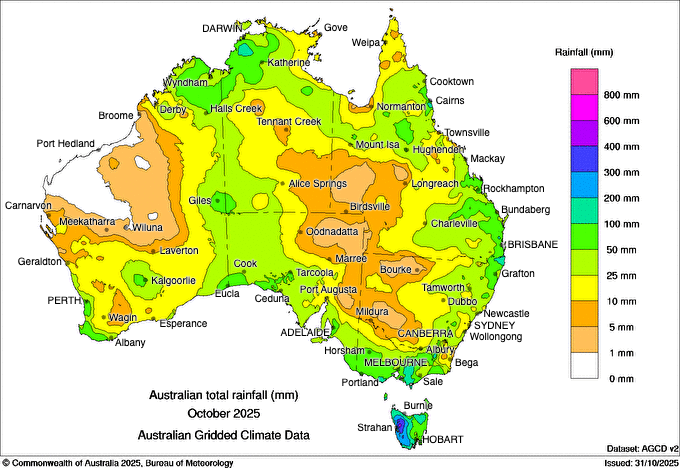

October Rainfall

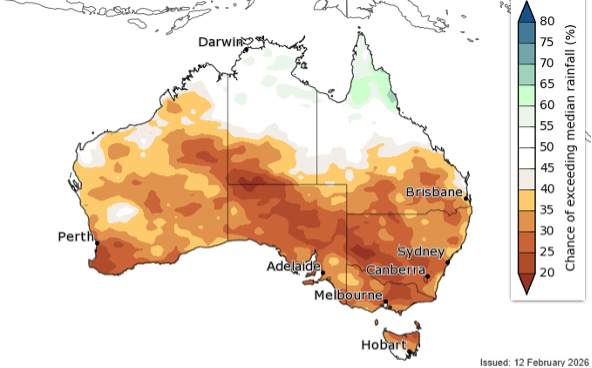

Much like the Bureau of Meteorology’s updated website, Spring rainfall was disappointing.

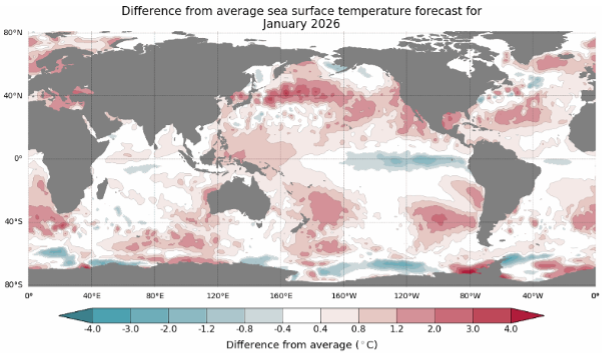

Rainfall patterns across Australia were highly variable and forecasts didn’t quite hit the mark for a lot of growers. Some regions scored a much-needed late moisture boost while leaving others to contend with an already dry finish. Eastern states fared best, particularly parts of Eastern NSW and VIC where several systems delivered regular top-ups. These falls helped stabilise later-sown wheat, barley and canola, and in some cases added valuable weight to grain still in the fill stage. Southwest VIC and pockets of Southeast SA experienced one of their wetter Octobers in recent years, which improved prospects after a challenging start.

Later planted crops in SA will benefit from the patchy storms that blew over in October and early November. Vegetation health indexes across SA and VIC indicated healthy crop growth through spring and great potential, so the late storms should finish these crops off nicely. Barley and canola may not benefit as greatly.

Overall, October rainfall did not drastically shift production prospects for the national crop. SA and VIC production should improve vs previous estimates, while NSW will likely shrink slightly. WA production could see records broken for another year on the trot which is a great result for our friends in the west.

US government shutdown – nearing the finish

The US government shutdown in October created a notable ripple effect across global grain markets by halting the regular release of USDA reports, including the critical WASDE, crop progress updates and weekly export sales data. For several weeks, traders were left without the usual reference points that guide global sentiment and balance-sheet assumptions. This lack of transparency introduced a risk-premium element into markets, particularly for soybeans, wheat and corn, where fund positioning often relies heavily on official US data.

The data gap coincided with the Trump/Xi trade discussions where frameworks for ag product purchasing volumes were discussed. The absence of weekly export sales figures meant the market could only infer buying volumes based on private-sector rumours, tweets and vessel line-ups, adding to uncertainty and occasional intraday volatility. Wheat markets also saw moments of support as rumours circulated of additional Chinese interest, although firm confirmation was limited.

With an end to the shutdown within reach, government functions will resume, and markets will need to digest a 10 course meal of data. The release of the WASDE on Friday night Australian time (14/11/2025) will kick off the data dump, with the resumption of regular reports to follow. The question on a lot of market participants lips is the extent of China buying, if at all.

The WASDE should also indicate a global balance sheet without any production holes or supply shocks that are needed to drive pricing higher. Global wheat buyers are comfortable, with ample supply coming online out of Argentina and Australia. The Southern Hemisphere wheat grower has outperformed in the 2025/26 season.

In a lower price year, any upticks in pricing are important to capitalise on.

While Advantage Grain’s pooling programs don’t pick the highs and the lows of the market, they do return the best price average over the period, meaning you will see benefit from the highs when they occur, without the risk of selling the lows.

For assistance with any grain marketing requirements please call your local Advantage Grain representative on the details below.

QLD and NSW: Jack Craig 0474 845 782

SA and VIC: David Long on 0427 012 273 or David Evans on 0437 176 280