Changing Patterns Building Confidence

Rowan Fessey, 15 August 2025

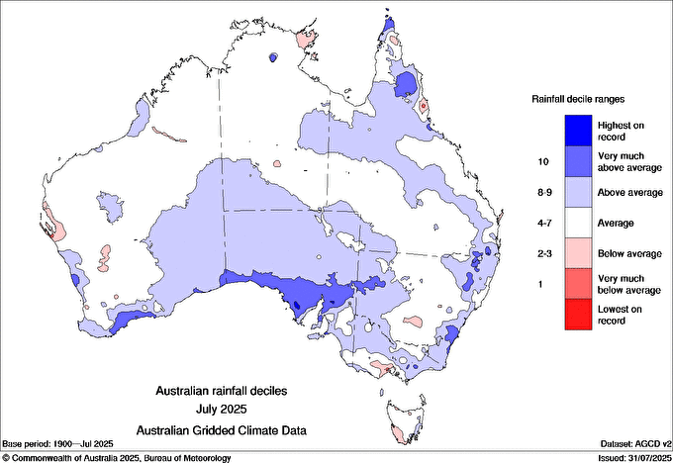

Australian 2025-26 production prospects are building momentum with regular constructive weather patterns working their way across the country through July.

The driest regions of South Australia finally received a well earned drink which will stabilise and grow new crop yields.

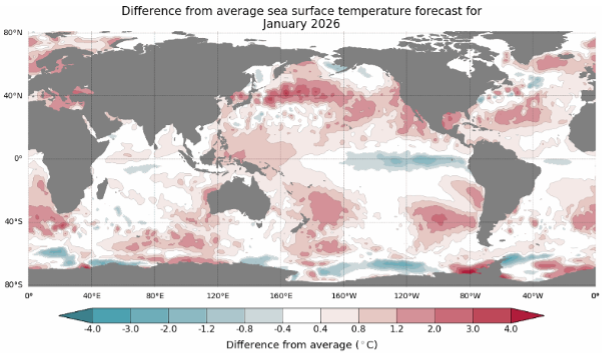

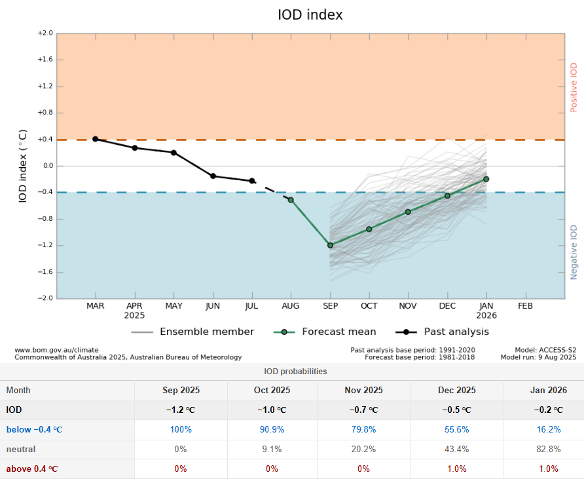

Looking ahead to the Australian spring, the Indian Ocean Dipole (IOD) is currently neutral, but nearby forecasts show values dipping below the negative threshold, with the latest weekly index at -0.84 °C for the week ending August 10, 2025. A negative IOD is increasingly likely to develop, as sea surface temperatures indicate warmer waters in the Eastern tropical Indian Ocean and cooler in the west. Forecasts from international models, including the Bureau of Meteorology (BOM), predict a negative IOD phase persisting through most of Spring 2025, before returning to neutral in early summer. This aligns with the typical IOD cycle, where events peak between August and October and decay with the monsoon arrival by late spring.

A negative IOD generally brings above-average rainfall to southern Australia during winter and spring, as warmer waters off northwest Australia supply more moisture to weather systems. The wetter patterns through winter so far are a positive sign for a wetter than average spring (touch wood!).

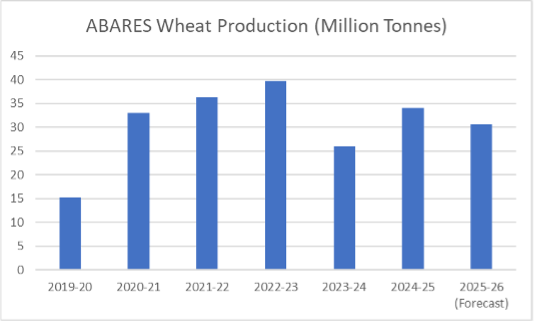

On the back of improving winter rainfall, the production outlook for Australian wheat, barley, and canola remains positive. The latest ABARES Report (June 2025) for the 2025-26 season, has wheat production forecast at 30.6 million metric tonnes (MMT) alongside the USDA estimate at 31MMT. Private analysts estimate range from 31-34MMT which reflects the improvements seen throughout July and hopefully with above average spring rainfall, the national crop can continue to expand.

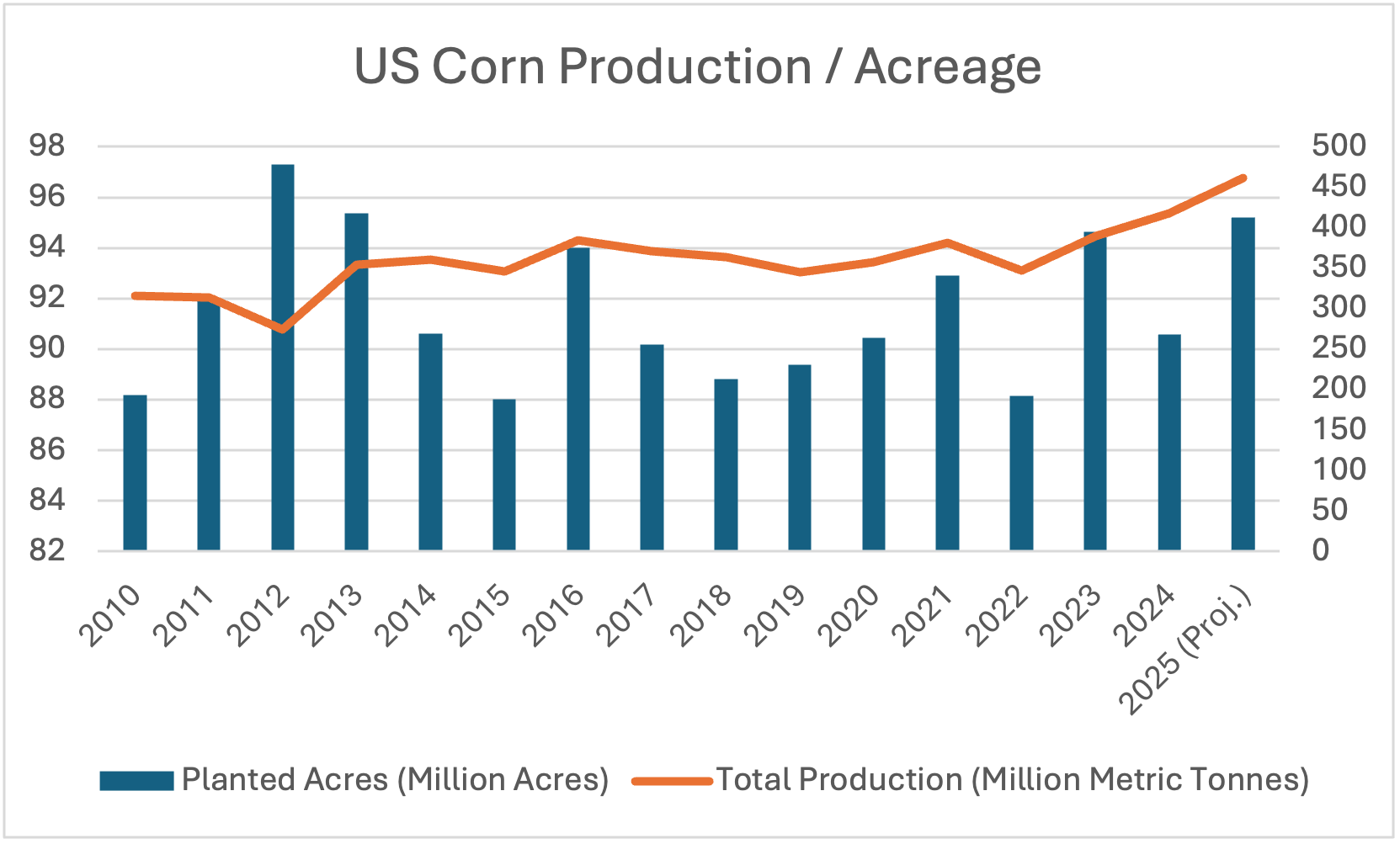

Corn Acreage Pops

The August 2025 USDA World Agricultural Supply and Demand Estimates (WASDE) report surprised the market with a drastically improved US corn production outlook for the 2025 crop, driven by favourable weather conditions and increased planted acreage. Planted area is estimated at 97.254 million acres, up 5% from 2024. With an all-time high average yield of 188.8 bushels per acre, benefiting from timely rains and mild temperatures. Total production is projected at a record 461.75MMT, a 13% increase over 2024's 417.49MMT.

The unexpected surge in corn production immediately added weight to the corn market and wider feed complex with corn contracts selling off aggressively. Cheaper and more readily available US corn will displace other feed sources into destination markets. The impact on the Australian market will be added competition for Australian lower quality feed wheats, ASW and barley into Asian markets and further abroad.

Geopolitical Challenges Creating Opportunity

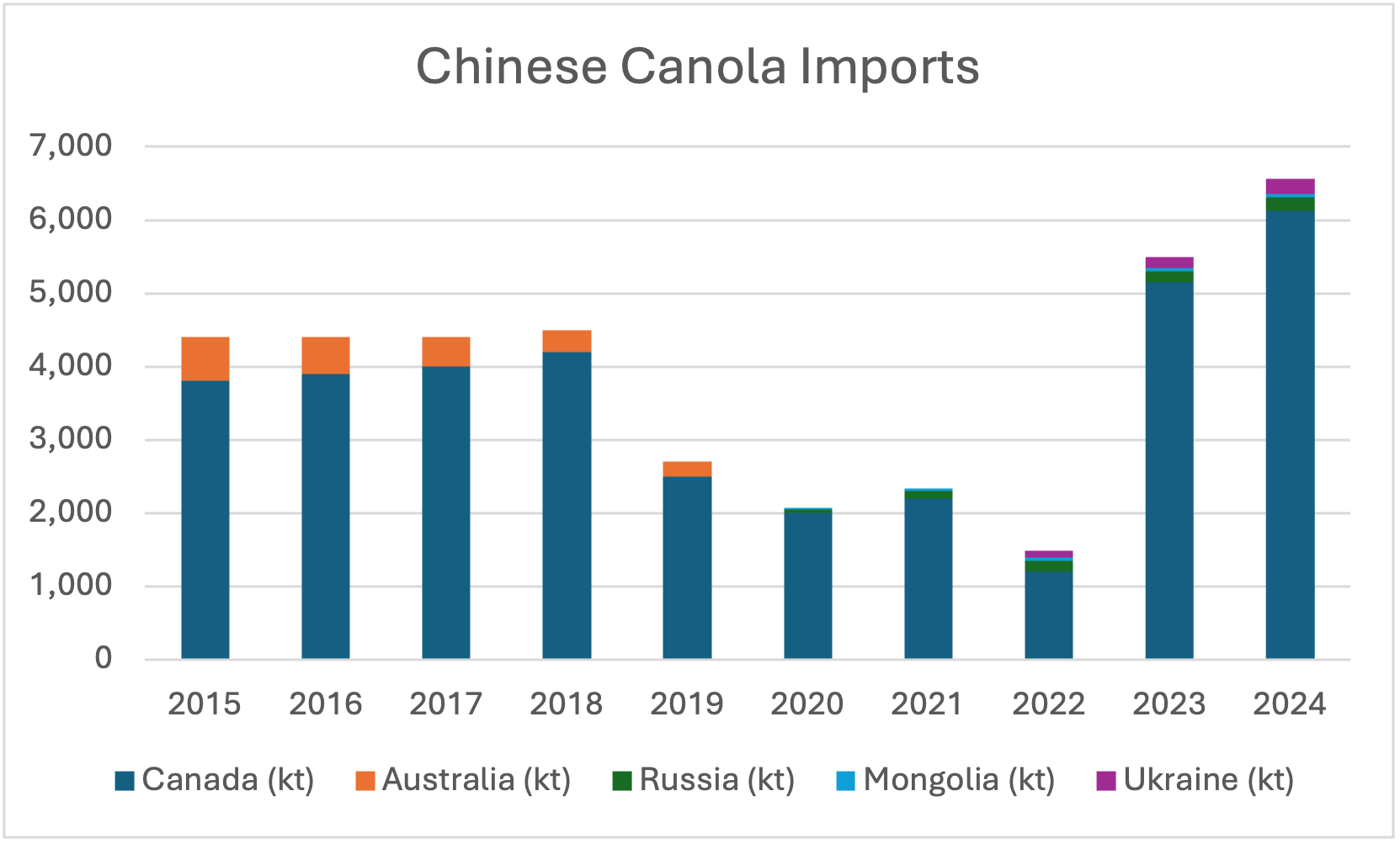

This week China accused Canada of dumping canola, alleging that government subsidies enabled unfairly low prices that hurt China’s domestic industry. As a result, China imposed preliminary anti-dumping duties of 75.8% on Canadian canola imports, effective August 14, 2025, escalating a trade dispute sparked by Canada’s tariffs on Chinese electric vehicles in 2024. The duties led to a sharp drop in ICE canola futures, threatening Canada’s C$5 billion canola export market to China, with Canadian officials rejecting the claims and vowing to support farmers while seeking alternative markets. While not an exact case of déjà vu, it’s all too familiar for Australian barley growers who endured the same treatment between 2020 and 2023. However, in the current circumstances, Australian growers should benefit from the halting of Canada-China canola flows. The move creates an opportunity for Australia to regain access to the Chinese canola market, with test cargoes expected this year after a trade freeze since 2020, primarily due to Chinese restrictions aimed at preventing fungal plant disease spread. Importantly, China is also a large consumer of GM Canola, which has struggled to find strong export demand out of Australia in recent years with widening spreads to Non-GM canola emerging.

What does it all mean?

As Australia heads into spring with strengthening rainfall prospects, the national grain outlook is shaping up to deliver solid production results across key crops. International market shifts and geopolitical tensions are adding both challenges and opportunities for growers, making strategic marketing more important than ever. Advantage Grain is here to help growers navigate these dynamics and make the most of their grain marketing opportunities come harvest.