Improving Global Crop Outlook and Growing Biofuel Demand

Rowan Fessey, 17 July 2025

Global grain markets are entering the crucial northern hemisphere weather period where crops are made and broken. So far, major grain producing regions in the Black Sea are on the mend, corn production in the US is going from strength to strength and the Australian 2025-26 crop outlook is improving.

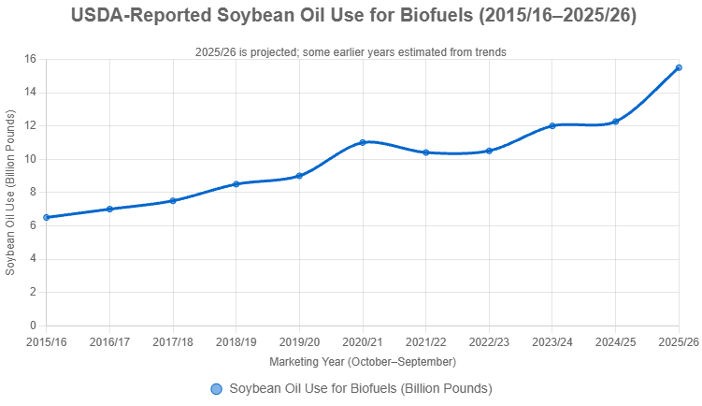

Oilseeds in the Energy Transition

The latest World Agricultural Supply and Demand Estimates (WASDE) report highlights a significant trend shift in U.S. oilseed usage, with soybean oil for biofuel production surpassing its use for human consumption for the first time. According to the July 2025 WASDE report, U.S. soybean oil usage for biofuels is projected to reach 15.5 billion pounds for the 2025/26 marketing year, a 12% increase from the previous month's forecast and a 23% surge over the three-year average. This shift, driven by recent EPA mandates and tax credits, indicates that 53% of soybean oil usage in the U.S. will be dedicated to biofuels, reflecting strong demand from the renewable energy sector, supporting soybean prices and the wider oilseed complex. The growing role of oilseeds in the energy transition is an important and ongoing theme for the global oilseeds market. Australian canola growers should feel the tailwinds of these shifts as more US production is absorbed domestically, and the traditional global consumer feels a tightening in the oilseed market.

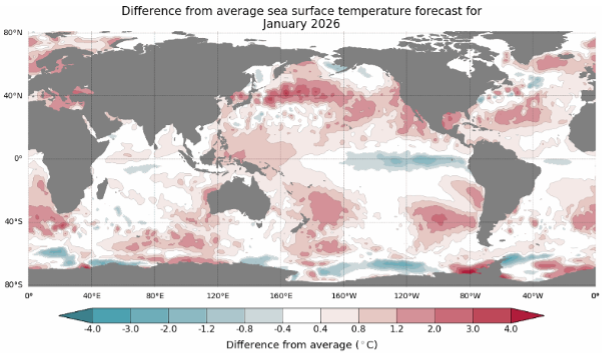

Improving Weather: Aus and Abroad

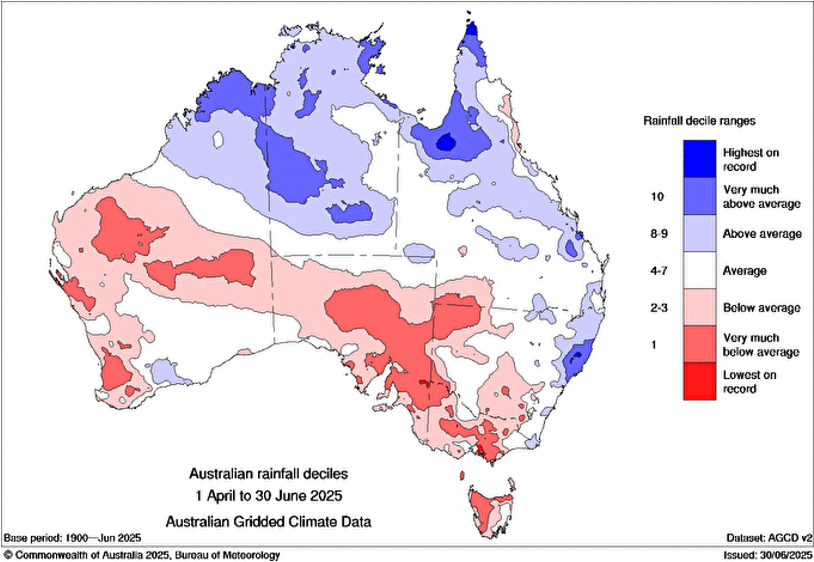

Improving weather across Western Australia and South Australia has bolstered the new crop production outlook and given growers confidence to progress or finalise old season grain sales. Favourable rainfall and milder temperatures in these key growing regions, has improved crop prospects for winter crops. After a dry start to the season, a shift in southern weather patterns have led to more consistent precipitation through June supporting crop development. Even with rainfall through June and July, a significant portion of the WA, SA and VIC growing belt is still well below seasonal averages.

The latest Primary Industries and Regions South Australia (PIRSA) crop estimates for the 2025/26 season project improved production compared to earlier forecasts. PIRSA’s June 2025 report estimates South Australia’s wheat production at 5.8 million metric tonnes (MMT), up 7% from the March 2025 estimate of 5.4MMT, driven by better-than-expected rainfall. Barley production is also revised upward to 2.1MMT, a 5% increase from the previous 2.0MMT.

In the U.S, improving weather conditions are boosting production potential for corn and soybeans. The USDA’s July 2025 WASDE report forecasts a record-breaking U.S. corn crop of 15.82 billion bushels with an average yield of 181 bushels per acre, supported by favourable rainfall and moderate temperatures across the Midwest. Private analysts are even more optimistic about corn production, with many coming in well above the USDA forecast. Soybean production is estimated at 4.34 billion bushels, with yields benefiting from timely rains in key states like Iowa and Illinois.

Russia’s wheat crop is also benefiting from improved weather, adding weight to the global balance sheet for the back end of 2025. After earlier drought concerns, recent rainfall and cooler temperatures in key wheat-producing regions like Rostov and Krasnodar has replenished moisture levels and is finishing the crop off. The July 2025 WASDE report has recognised these improvements by increasing their estimate of Russia’s wheat output to 83.0MMT for the 2025/26 season. Another solid Russian wheat crop takes some of the pressure off the global balance sheet with the worlds go to low-cost supplier replenishing supplies.

What does it mean?

Australian wheat pricing will need to maintain competitiveness on the global market against restocked and improving Russian and US supplies to close out the 2025 calendar year and beyond into new crop. The positive weather outlook and overall improving production prospects in Australia will give growers, consumers and exporters more confidence over the coming months. Volatility throughout the northern hemisphere spring and into Australian harvest is common, particularly in this highly charged geopolitical environment.