Indian Wheat Supplies May Not Save the Day

As the Black Sea conflict enters its third month, global consumers of wheat look to other producing origins to make up for the lost Ukrainian supply. Consequently, normal suppliers such as Australia, Europe, Argentina and North America have seen an uptick in demand. Interestingly, India has stepped in as an unlikely supplier to the world for its food needs. However, this supply may be short lived. La Niña driven weather continues to make for hard seasons in both North and South America. Australian growers commence their growing season in largely strong conditions; however, not all parts of the country are enjoying supportive wet weather.

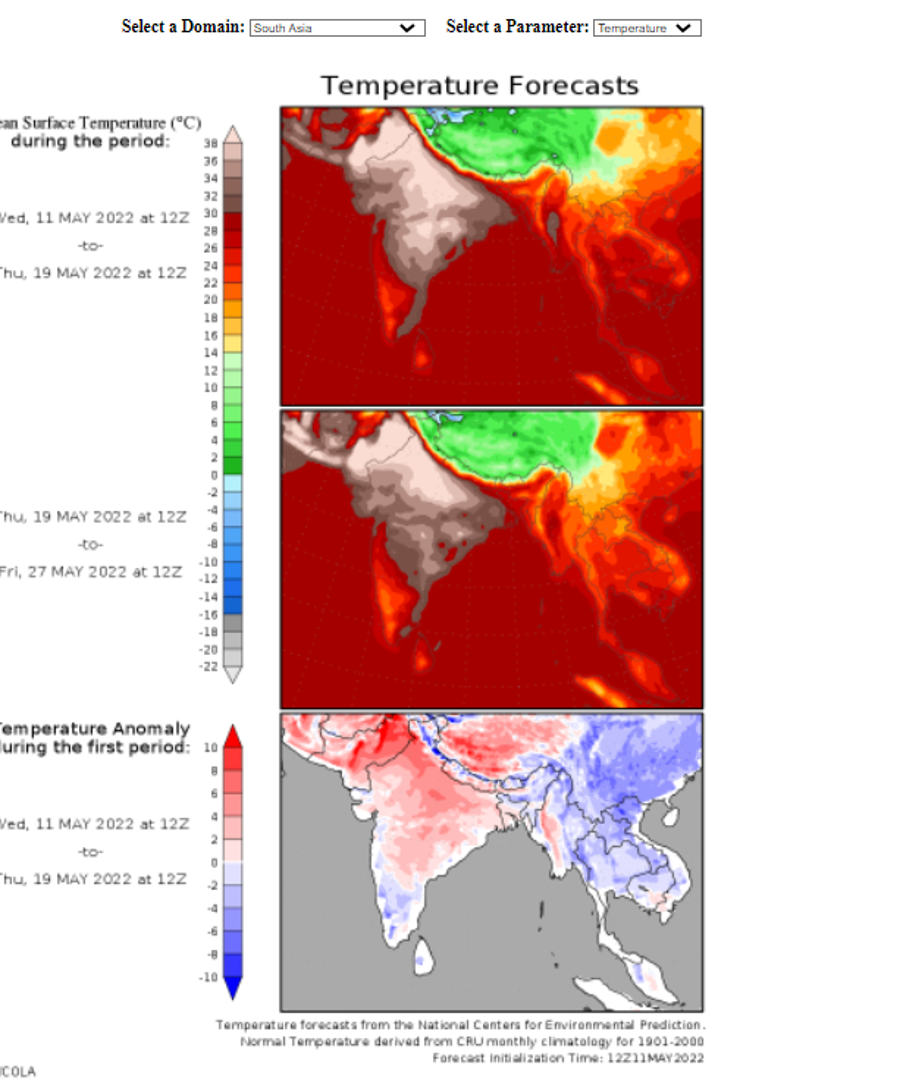

Hot and hard finish in India

Indian wheat producers are currently in the harvest phase of their season. As they cut through the crop, the world watches to see how badly yield has been impacted by excessively hot and dry weather over March and April. A May 3rd article on cnn.com reported that northwest and central India had experienced its hottest April on record in 122 years of data keeping. The article went on to interview Gurvinder Singh, director of agriculture in Punjab…. “an average increase of temperature by 7 degrees Celsius had reduced wheat yields”. Mr Singh went on to state “because of the heatwave we’ve had a loss of more than 5 quintal (500 kilograms) per hectare of our April yield”. The USDA currently has India in for 10MMT of wheat exports to help alleviate the lost supply from the Black Sea. However, a hard finish to the season most likely means this is not realistic.

Figure 1: http://wxmaps.org/outlooks.php

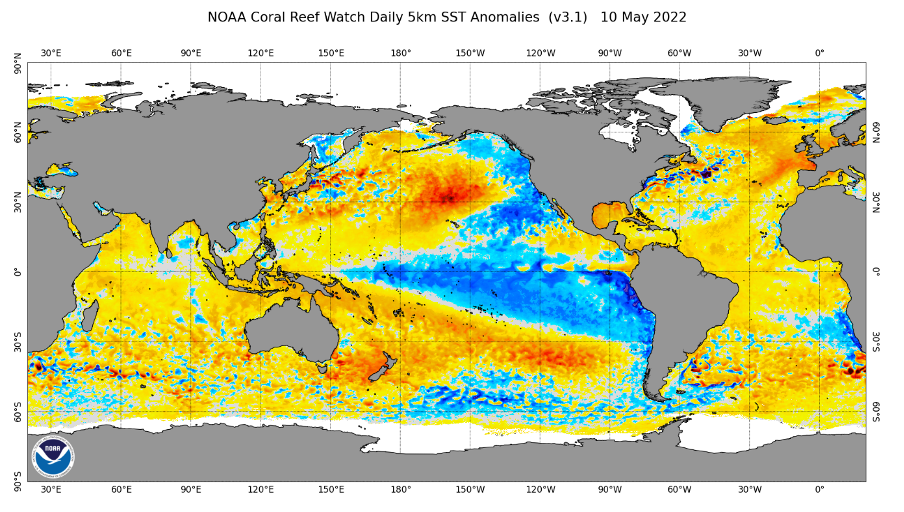

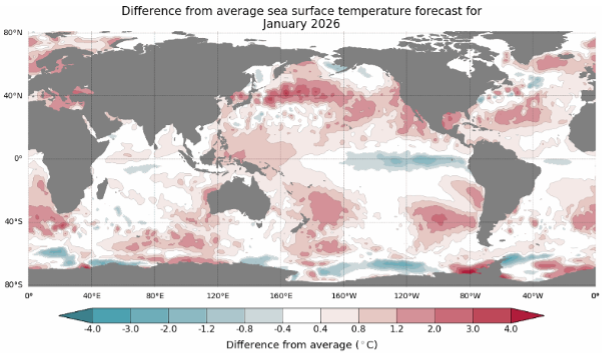

Ongoing Impact of La Niña

Through last harvest most weather analysts were predicting La Niña to subside. However, this has not played out. Over the months of March and April the Pacific Ocean weather temperature phenomenon strengthened with persistent cold waters off the western coast of South America. The impact of this has been a continuation of hot and dry weather in Argentina. The Rosario Grain Exchange currently estimates Argentine new crop wheat production at 19MMT which is down from 22MMT last season.

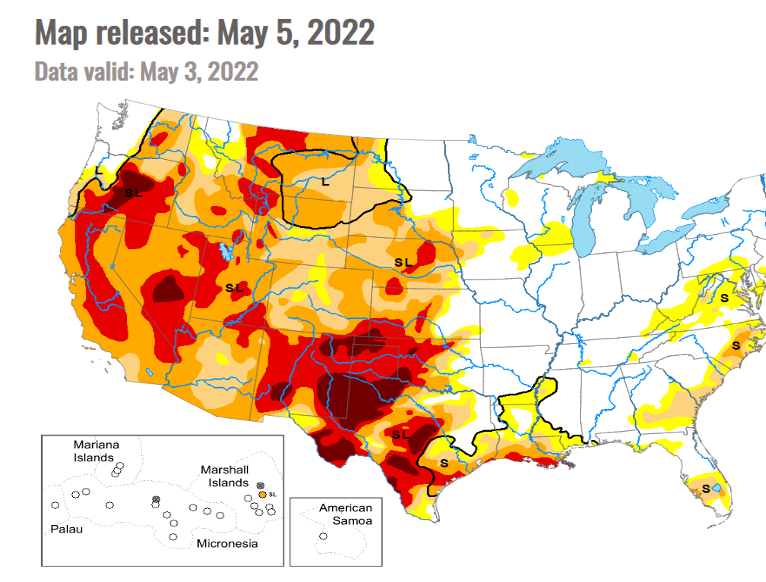

Crop Ratings in Kansas

Cold water off the coast of Baja, south of California, has also contributed to blocking patterns in the Southern Plains of the United States. In their last update, the USDA rated crop conditions in Kansas at 28% good to excellent vs a rating at this time last year of 53%. The current rating is likely to decline on account of hot and dry conditions presently in place.

Figure 3 https://droughtmonitor.unl.edu/

Closer to Home

In their most recent update, the BOM is calling for a weakening of the La Niña pattern and strengthening of the negative IOD in the Pacific Ocean. If this occurs, the extremely wet weather being experienced in Southern Queensland and Northern New South Wales should normalise. Also, a negative IOD should improve rainfall in Western Australia, South Australia and Western Victoria. Although, most of the country is off to a positive start with soil moisture; there are many growers in South Western NSW, Western VIC and SA that are not experiencing an ideal start. We hope conditions improve for our neighbours in these areas.

We are pleased to report strong results for the Advantage program this year with month over month improvement of returns as strong demand for Aussie grain continues. Canola, wheat and barley pricing is all up markedly since harvest. Without an end to the conflict in Ukraine and ongoing weather risks in North and South America, this strong demand should continue and remain supportive to grain prices. Best of luck to everyone with the current sowing campaign!