Global political and weather volatility continues while Aussie has a kinder June (for some)

Volatile Black Sea Politics Continue

NATO or the North Atlantic Treaty Organization was founded with the signing of The Washington Treaty on April 4th, 1949, by 12 original members. Membership currently stands at 31. The stated mission is “to guarantee the freedom and security of its members through political and military means”( https://www.nato.int/nato-welcome/index.html

). It was announced this week that Turkey had agreed to allow Sweden to join the collective security alliance after holding out over the last 12 months.

Below is a list of member countries and the year they joined.

Figure 1 - https://www.nato.int/nato-welcome/index.html

At this stage, it is not clear what impact this will have on the extension of the Ukraine food corridor. Notably, Turkey was the main country to lobby Russia to support the grain corridor during the negotiation process for the last two deal extensions. The most recent extension is due to expire on July 18th, 2023. Russia has stated there can be no further extensions without removing a list of sanctions currently in place. Although, operating at approximately half the pre-war pace, Ukrainian grain and oilseeds exports through Black Sea bulk terminals currently account for roughly 2.5 MMT per month ( https://www.un.org/en/black-sea-grain-initiative/vessel-movements

)

and would be difficult to achieve via land-based logistics. It is worth noting, the Odessa port facilities were subjected to rocket attacks the day following Turkey’s about-face on NATO membership.

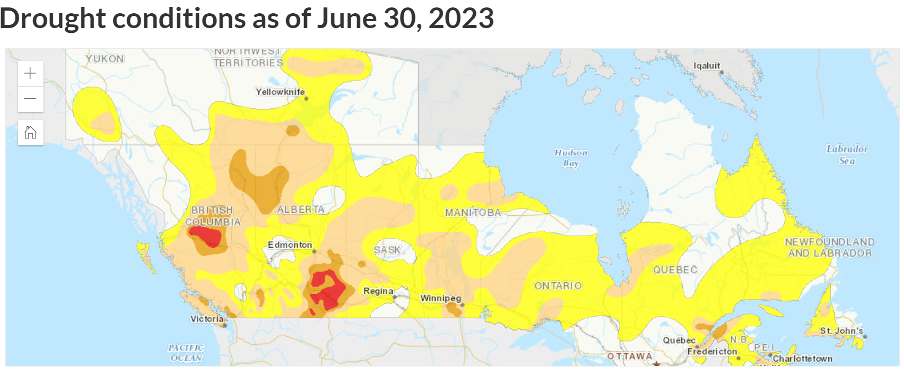

Patchy North American weather continues

Over the month of June, the Midwest of the United States suffered one of its driest periods in 40 years. Crop ratings were downgraded and futures grew increasingly volatile. Over the first week of July, rains returned to areas desperate for moisture. US corn and soybean crop ratings are still at historical lows but the worst-case scenarios have been removed. However, central growing regions in Canada continue to experience severe dry conditions

As a result, we have seen Winnipeg canola futures rise $170 CAD per metric tonne since June 1st with approximately $80 AUD per metric tonne translating to the local markets. Although we don’t wish dry conditions on anyone, this crop production threat has helped to stabilise global canola prices after a challenging first six months of the year. The current 14-day outlook does not offer any widespread rain events for the hardest-hit Canadian areas.

China barley update

July 12th, 2023 marked the end of the three-month period for China to conduct its review of the barley tariff dispute. Chinese regulators have requested a one-month extension to conduct their review. This extension was agreed as part of the process in April. Much of the industry remains hopeful that China will extinguish the onerous tariffs in time for harvest of our new season produce.

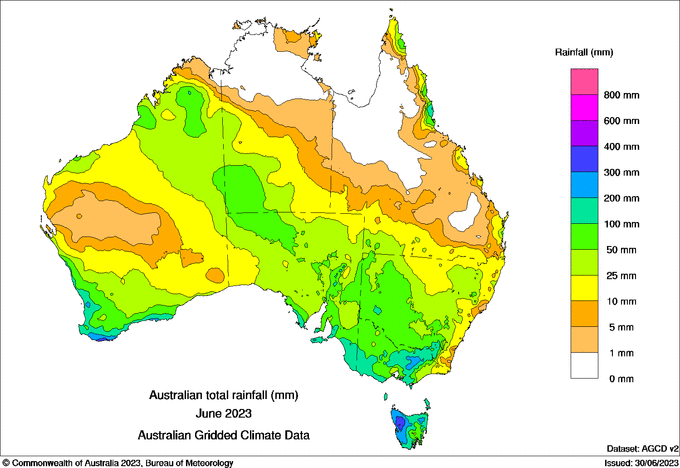

BOM June outlook does not come to pass

Over the month of June, much of Australia (not all) received greater than forecast rains. This came as a welcome relief to the BOM forecast which had called for lower than average rainfall and higher than average temperatures for much of the broadacre cropping belt around the country. This rainfall outperformance has set many areas up with a decent base. However, parts of the country including much of Queensland, parts of northern and western New South Wales and northern Western Australia are still suffering from soil moisture shortfalls.

Figure 3 - www.bom.gov.au

Summary

The Black Sea conflict continues to create uncertainty in agricultural markets as proponents of the Ukrainian food corridor look for a last-minute agreement to extend the supply chain. Turkey’s support of growing NATO adds to the brinkmanship in the region and does not bode well for a compromise with Russia.

Weather challenges to the growing seasons in the United States and Canada have increased market volatility since the start of June with canola being the main beneficiary. It is important that both countries have a near ideal second half to the season to attain trend yields.

The BOM maintains a concerning outlook for winter and spring weather in Australia. However, June national rainfall coverage was a pleasant surprise to the upside with many production areas now with solid moisture profiles in hand.

As political and weather volatility continue, Advantage is in the markets day in and day out marketing grain. Pool management focuses on the business of grain markets so that clients can focus on the business of farming.