Feed wheat, a harder season for Northern Hemisphere crops and El Niño Alert

Over the last month, we have seen excessive rainfall in China in the lead-up and during their local wheat harvest. EU winter crops and Russian spring wheat are all experiencing a hard finish to their growing season. Closer to home, Aussies brace for a possible impact from the El Niño alert issued by the Bureau of Meteorology (BOM).

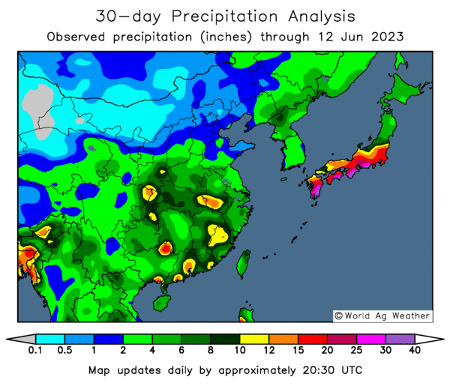

China’s excessive rainfall

Two weeks of heavy rainfall over the end of May and the beginning of June has battered the Chinese wheat harvest. In the Hanan province, it is estimated that as much as one-third of the wheat crop could be sprouted. In a province expected to produce 40 million metric tonnes (MMT) of wheat, this could equate to over 10MMT of downgraded wheat that is unfit for human consumption. A June 7th article released by Reuters stated “Imports of wheat into China are already going up….if there is damage to the crop….then it’s likely that China will need to increase its imports next year”. ( https://www.reuters.com/markets/commodities/chinas-wheat-growers-face-disaster-after-heavy-rain-batters-crop-2023-06-07/ )

Figure 1 - www.worldagweather.com

Once the rain settles, it is most likely that China will suffer 5 – 10MMT of wheat downgrades this season. They are already a strong buyer of Australian wheat accounting for over 5.5MMT of Australian wheat exports so far in the 2022-23 season. It looks like this trend may be set to continue.

USDA Crop Conditions Update

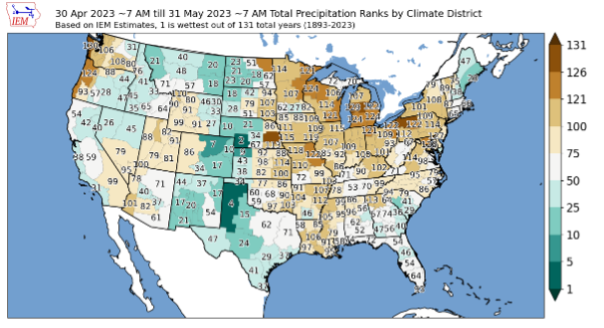

On Monday, June 12th, the USDA updated their crop conditions for corn and soybeans. The weekly rating system has corn at 61% good to excellent. This is down from last year’s 72% on the same date and a 10-year average of 71%. The soybean crop ratings showed similar disparities. This is following on from one of the driest Mays in history for the eastern corn belt of the United States. As a consequence, we have seen futures values jump from their lows of late May. US corn growers require a strong turnaround in weather with consistent follow-up rainfall to avoid real yield penalties this season.

Figure 2- www.mesonet.agron.iastate.edu

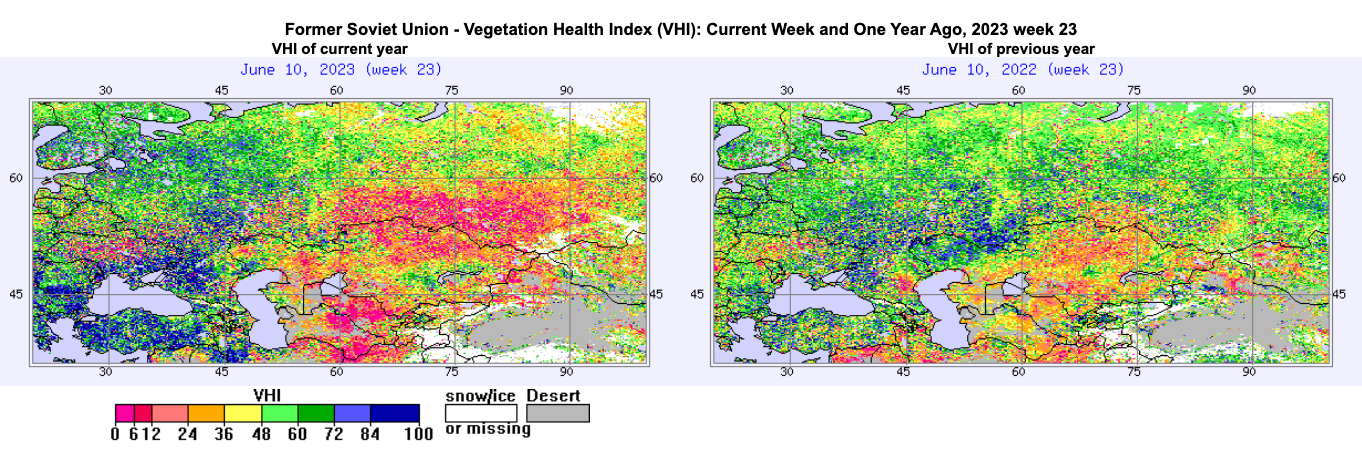

European Union and Black Sea crops face a tougher finish

The EU and Russia have both enjoyed a positive season through the Northern Hemisphere spring. However, as Northern Europe’s summer starts, the spring wheat regions of Russia have turned dry. At this stage, it does not appear to have affected markets, but a continuation would take the top off production. One of the weights on global grain markets over the last few months has been the bigger than expected Russian wheat exports. A hard finish for their spring wheat would reduce Russia’s ability to continue exports at this pace.

Figure 3 - www.star.nesdis.noaa.gov

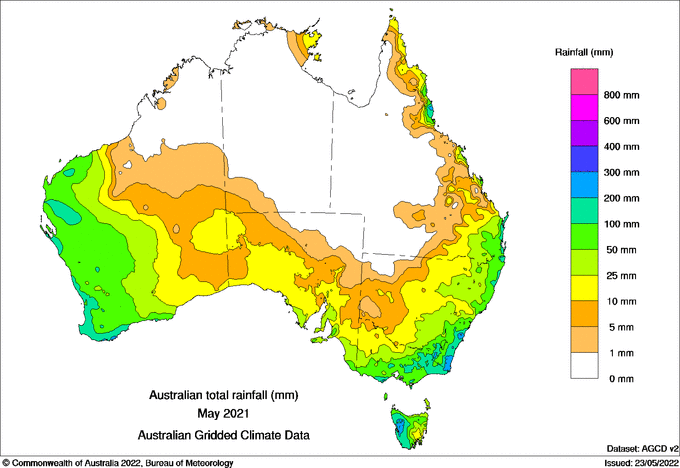

BOM raises ENSO outlook to El Niño alert

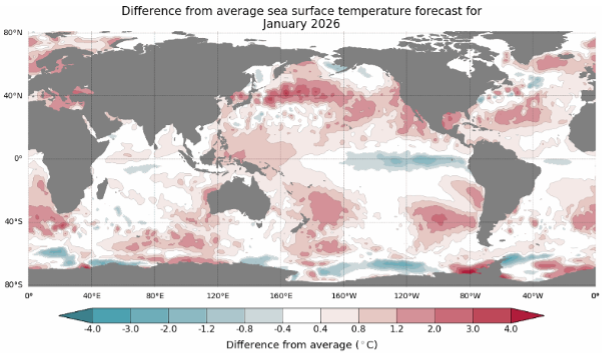

On the 6th of June, BOM raised the ENSO outlook from El Niño Watch to El Niño Alert. This update means there is approximately a 70% chance of El Niño forming at some point in 2023.

An El Niño does not guarantee an extremely hard season in Australia. In the last four major El Niño events going back to 1997, three produced a year over year decrease in national production. Of those three years, only one, in 2002, measured a decrease in production greater than 16% from the prior season.

It is worth noting that soil moisture in many growing areas through the Australian wheat belt is good. On top of this, recent rains through growing regions from WA’s Great Southern through SA and VIC and up into Southern NSW have further improved the outlook. Although, there are some areas that missed out.

Figure 4 - www.bom.gov.au

Overall, there is a long growing season with plenty of uncertainty ahead for both the southern and northern hemispheres. One thing is for certain though – grain price volatility will continue.