The Year of the Dragon

Rowan Fessey 16 February 2024

China, one of the world's powerhouse economies, has been making headlines of late due to a pullback in its real estate and stock markets. This economic downturn is combined with a population that has been slow to come out of the Covid-19 lockdowns. Consequently, consumer price deflation is creating headwinds for the persistent growth that China has experienced over the past decades. However, amongst the economic slowdown, commodity imports remain resilient which is positive for Australian grain growers.

Chinese Property Headwinds – what is happening?

Property development in China is a central pillar of the economy and the key feature of the Chinese hybrid of combining government central planning with a free market approach. For years the Chinese government has incentivised infrastructure development as the key to economic growth, with the property sector now accounting for around 30% of China's GDP. Australia has been a major beneficiary of China’s property construction with raw materials, grain and meat fueling the Chinese construction industry and its labourers.

Similar to Australian property, Chinese property has been a proven method for households to grow wealth in China over the past decades. As a result, it is estimated more than 60% of household wealth is tied up in Chinese property which makes it all the more ominous when there are issues in the real estate sector.

The Evergrande Group, China's largest real estate developer began having issues in 2021 and has recently been ordered to liquidate all assets leaving normal Chinese household investors at risk of losing investments. However, a large program of government support looks to have stabilised the sector, slowing the property price declines.

Stability is also showing in the resilient pricing of key materials such as iron ore and coal with demand remaining robust. This is optimistic for our grain exports with Australia needing a healthy Chinese economy to ensure our sales continue to our best customer.

Figure 1 - https://www.barchart.com/

Advanced Wheat & Barley China Purchases

Chinese agricultural purchases have remained strong through the Australian harvest period right up until the current Chinese New Year holiday break. Against the backdrop of a slowing Chinese economy, the sales of Australian wheat, barley and sorghum into China are well advanced for this marketing year. The barley trade has been particularly strong since the removal of tariffs five months ago.

February WASDE data released last week reduced the estimated Chinese wheat imports slightly, from 12.5 million metric tonne (MMT) to 12MMT for the 2023-24 marketing year. Even with this reduction, 12MMT of wheat imports would still be the second largest level of Chinese wheat imports in the last 25 years, of which Australian grain should make up the majority.

To put the Australia to China wheat export program into perspective, in 2021-22 Australia exported 6.3MMT out of 9.57MMT million tonnes and a whopping 7.66MMT out of 13.28MMT national wheat crop in 2022-23 to China. So far this marketing year it is estimated that 4-5MMT has already been sold to China. According to ABS data, 700 thousand metric tonnes (KMT) was shipped between October and December 2023. These wheat sales to China will continue to be executed over the coming months out of most Australian port zones.

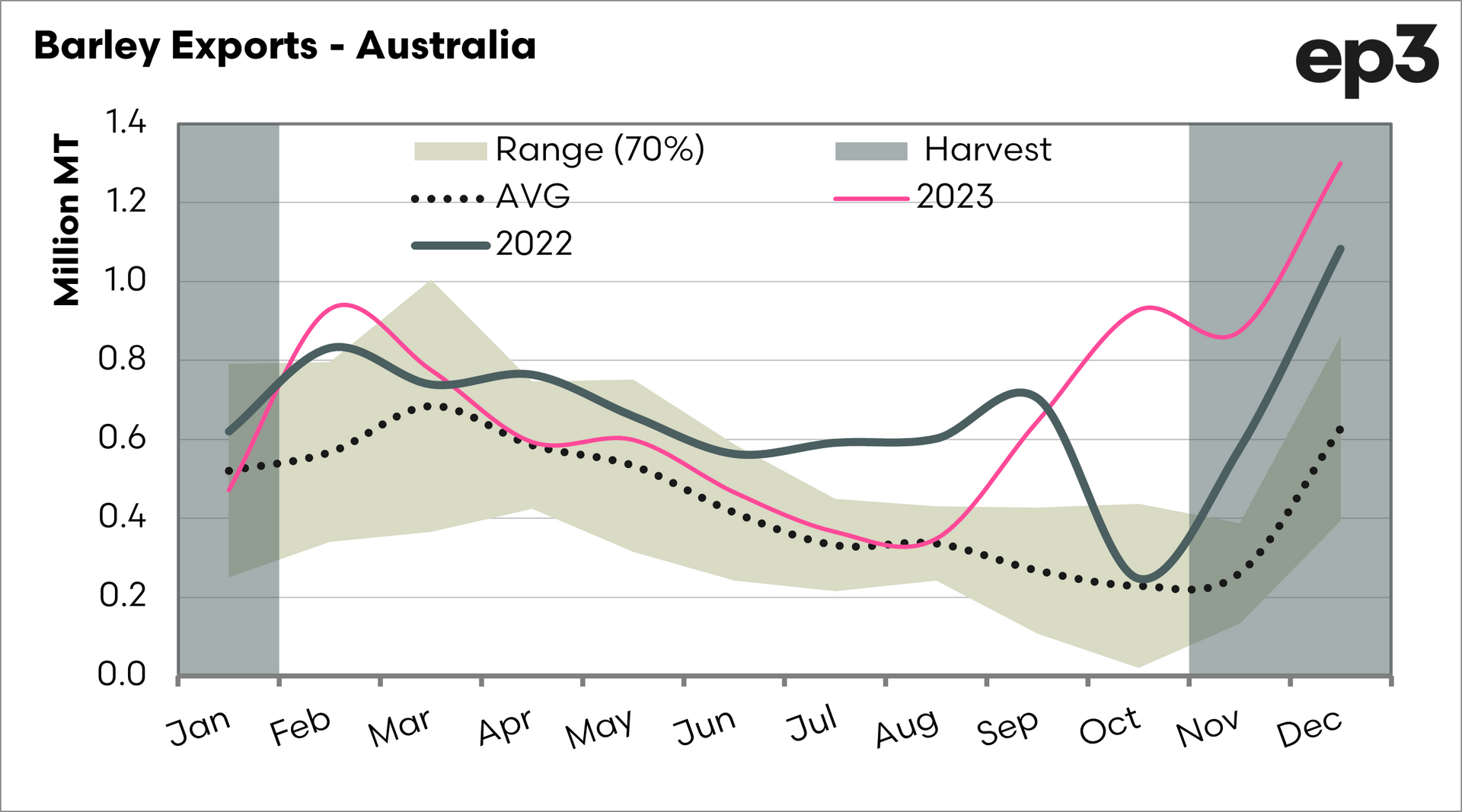

Australian barley sales are well advanced with 1.3MMT of barley exported during December 2023. Western Australia accounted for 651KMT with 469KMT from South Australia and a further 168KMT from Victoria. China was the primary destination with 1.16MMT shipped. The remaining 123KMT went to Japan.

China imported 2.52MMT of Australian barley between October and December 2023 and a total of 2.95MMT since exports resumed post tariff reduction. To put this in perspective, Australia’s total barley exports equaled 3.1MMT between October and December 2023. This is already around 50% of analysts' forecasted barley exports for the full marketing year. With the national barley export program so well advanced there is potential for over exporting and a tightening of the domestic barley SnD if sales continue at the current pace.

What does it all mean?

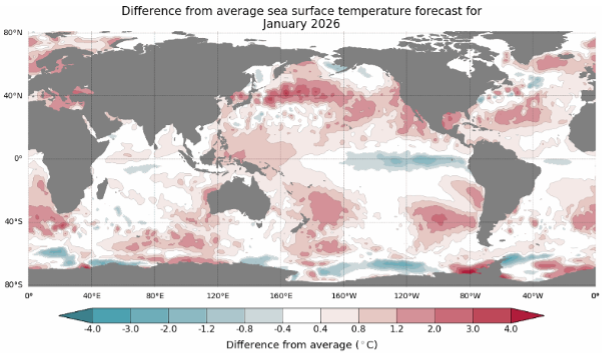

We have seen grain markets experience headwinds over the last few months and will need a catalyst to get them kicking again. That could come in the form of a weather issue in one of the world’s production areas. China, our largest grain trading partner, has shown us that although they may have economic headwinds of their own – their demand for all commodities remains strong. No one can pick the market top or bottom but a structured and disciplined grain marketing program will protect farmers in times of price uncertainty.