2024 – The Year of the Producer

2023 has been a volatile year for commodities markets. Although the war in the Black Sea continues, Ukrainian supply has slowly returned to the market. This has led to an overall decline in grain prices since this time last year. The world’s consumers have benefitted, but is the tide about to turn? If 2023 was the year of the consumer; will 2024 be the year of the producer?!

Figure 1 March 2024 CME Wheat over the last 12 months

2023 Recap

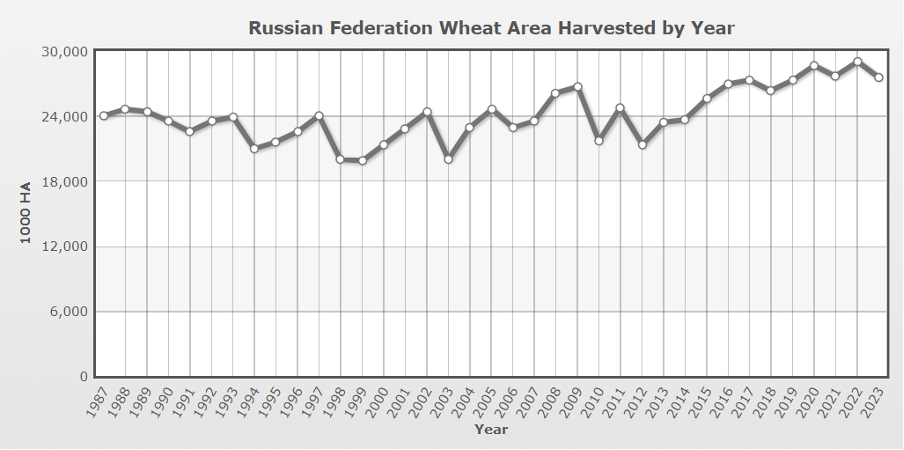

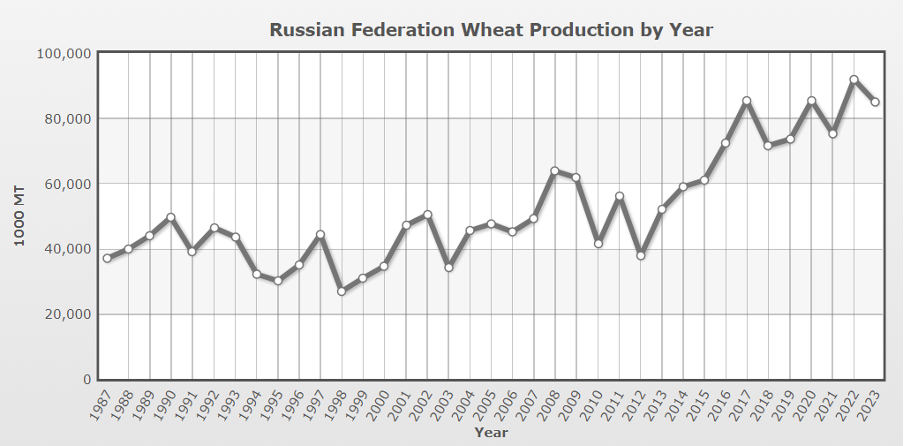

2023 saw strong production outcomes in Europe and the Black Sea which impacted their local prices and made it difficult for Aussie grain to compete into Middle Eastern and North African markets. Russia has been in a fortunate position over the last two years to offer several large harvests in a row. The following two charts are from indexmundi.com.

The first chart shows the increase in acreage since the 2000’s. The second shows the increase in production over the same period. Where acreage is up by 10-15%, production is up by 30%. A large part of this increase is due to the quality of the seasons. Over the last 10 years, Russia simply hasn’t suffered a long lasting or high impacting drought. This is following devastating droughts in 1998, 2003, 2010 and 2013. In this instance, it is good to be good, but it is better to be lucky.

Figure 2 www.indexmundi.com

Figure 3 www.indexmundi.com

US wheat, corn and soybeans all suffered tough seasons in 2023. Two years of drought in the southern plains has led to a reduction in carry out in North America. Below trend production in Argentina, Canada and Australia this year has also had an impact. Overall, global carry out of wheat is anticipated to drop to 32% stocks to usage from 34% last year. If you remove China and India, the global carry out looks much worse. There is no room for another global production issue in wheat over the coming months without seeing a meaningful impact on prices.

Outlook for 2024

Although Australia had an impending El Nino for most of the year, our basis values did not improve until late in the year. Nationally, Australia will produce approximately 25 million metric tonne (MMT) of wheat this season. This is down from last season’s record 39MMT. The start of the 2024 calendar year will present southern hemisphere exporters with much less wheat to offer the world’s consumers.

It is currently anticipated that France has sown the smallest amount of wheat since 2000.

Record rainfall in France at the end of the sowing window has recharged water tables but prevented growers from completing their sowing program. The outcome is that 15% of the normal winter wheat sowing will be abandoned.

After two and a half years of drought, Argentina is finally returning to a normal production cycle. Their winter wheat production will complete at a poor 15MMT but it is expected that production of corn and oilseeds will rebound in the coming months. Also, a new anti-interventionist government is in power – it is hoped that export duties will be removed, but there have been no firm commitments at this stage. Alternatively, in the north of the continent, Brazil is expected to show a decline in oilseed production due to ongoing drought. This will also push back corn plantings in the new year, and it is likely that any pick up in Argentina will be offset in Brazil.

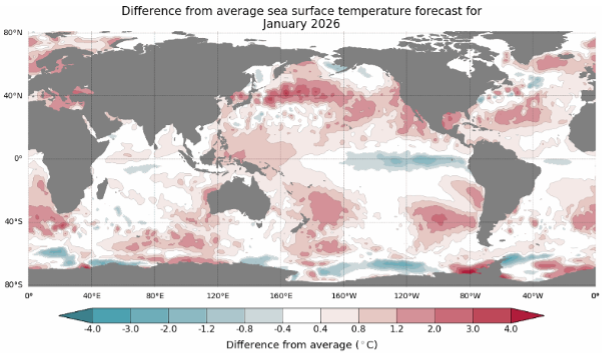

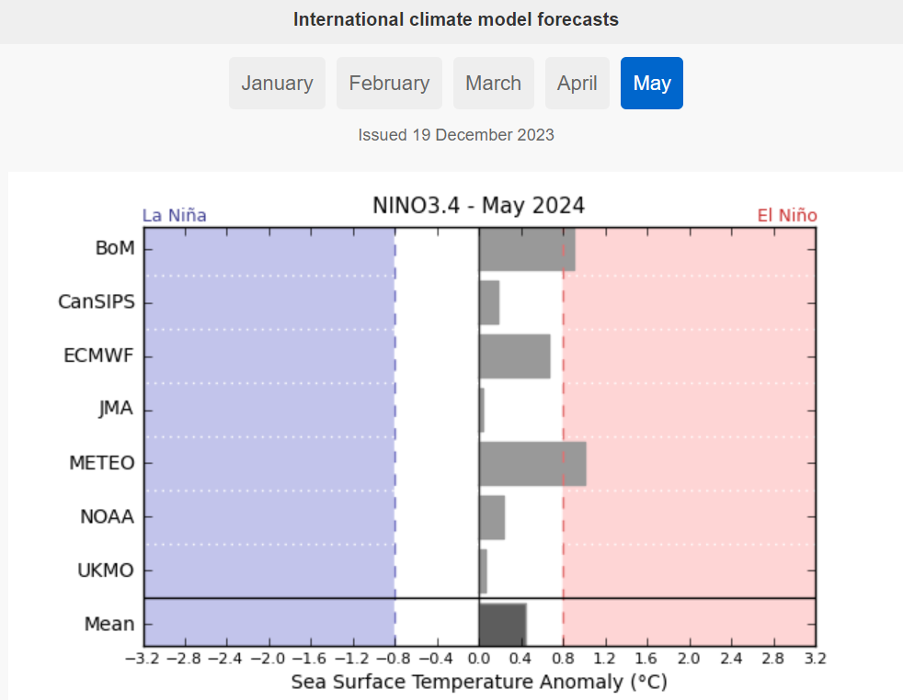

Closer to home, Australia is in the grips of an El Nino weather pattern which decreases the probability of rainfall and increases the probability of heat. However, the BOM is currently predicting this weather pattern to fall away early in 2024. Some forecasters are calling for the return of La Nina by mid-year!

Figure 5 www.bom.gov.au

What does this mean for grain prices?

A slow grind lower in prices over 2023 has benefited the global consumer at the expense of the global producer. However, it could be that the tide is turning with much decreased southern hemisphere production and risks that the coming season could not be as strong in Europe. Also, after a string of bumper harvests, does Russia’s luck run out?

Over 2024 we have a lot of production weather to get through, both locally and internationally. Also, we are entering an age of more and more political intervention. Be it in the form of aggression in the Black Sea or policy based such as in Argentina. As always, the markets will continue to be volatile and somewhat unpredictable. Under these circumstances, it is prudent to utilise a low risk and structured marketing program for your grain. Advantage Grain looks forward to working hard for Aussie growers again this coming marketing season.

Let’s hope 2024 is the year of the producer!