Volatility Continues as Putin shows his grip over the Black Sea Supply Chain

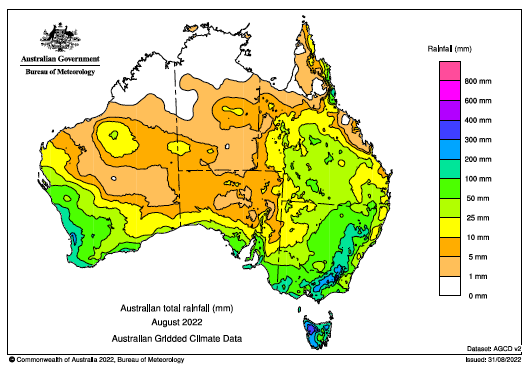

What a difference a week can make! Since Russia and Ukraine signed the UN brokered Food Export Corridor deal in July, we’ve seen reduced market volatility compared with the first half of the year. However, last week we saw how sensitive these markets are to possible changes in this agreement and how world wheat supplies are still struggling without adequate Ukrainian products. Closer to home, Australia is looking well set up to reach a forecast production of 55MMT, the fourth largest on record, with favourable weather set to hit key production areas during the vital spring growing period.

Over the past few months, we’ve seen the export corridor for Black Sea production slowly improve, allowing Ukrainian and Russian wheat to trickle onto the global market. A speech from Putin at the Eastern Economic Forum last week showed us how quickly the script can flip and how sensitive these markets are to changes in rhetoric from the Russian leader. In his speech, Putin cast doubt on the longer-term viability of the UN brokered Food Export Corridor, stating “Russia had signed the deal in July, on the understanding it would help alleviate surging food prices in the developing world, but instead it was rich Western countries that were taking advantage of the deal” ( Reuters, September 2022 https://www.reuters.com/markets/europe/putin-says-wants-restrict-destinations-ukraines-grain-exports-2022-09-07/ ). Reuters reported that during the forum, Putin expressed that he believed Russia had done everything it could to ensure Ukraine was able to export its grain, but problems on the global food market were likely to deepen.

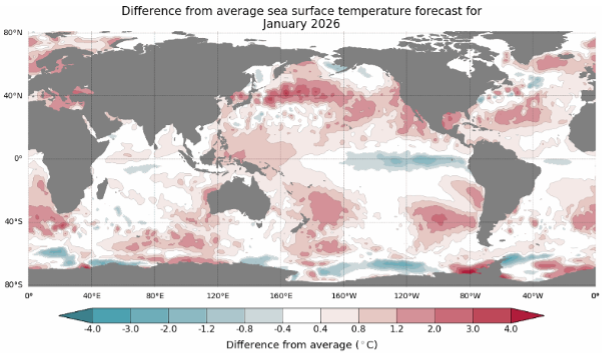

So, what does this mean for grain markets? Australian growers know all too well the financial impacts global disputes can have on their production and its marketable value. At times, we have been the beneficiaries, but have also lost key markets for products such as barley. The volatility that policy changes and global events create has been particularly extreme this year with monthly trading ranges on wheat markets at historic highs. Putin casting doubt on the Food Export Corridor deal could cause this to continue as we head into harvest and the new crop marketing season.

Figure 1 : December 22 CBOT monthly range AUD/MT

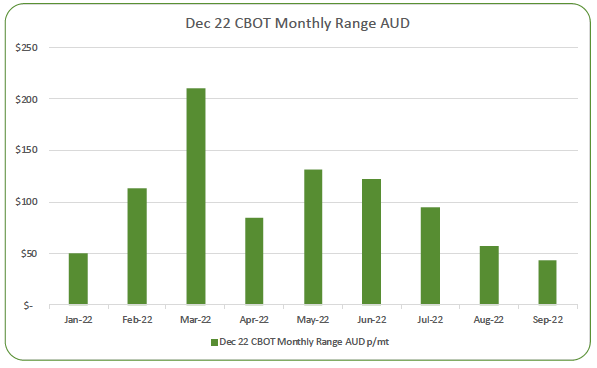

Closer to home, the Australian 2022/23 season continues to gather momentum with more rainfall across key production areas throughout August.

ABARES released their September production estimates for the new season with total winter crop production in 2022/23 forecast to reach 55MMT, which would be the fourth largest ever. Wheat production is forecast to be the second highest on record at 32.2MMT, which is an 11% decrease from the record level reached last year. Barley production is forecast to reach 12.3MMT, the fourth largest on record. Canola production is forecast to also reach the second highest on record at 6.6MMT, a 2% decrease from the record reached last year.

August 2022 National Rainfall bom.gov.au

Australian exports will be in high demand again in 2023 with ongoing tight global balance sheets and an unreliable and diminished supply chain coming out of the Black Sea.

Over the 2021/2022 marketing season we have seen extreme price volatility. Global supply chains will continue to attempt to adapt to the war in Ukraine, however, as seen last week, the environment can quickly change, and return us to the extreme grain price volatility we have experienced this year. In environments like this, having a professional team in the markets every day on your behalf can provide real value to your business. The Advantage pooling products have achieved strong results for growers this year, capturing volatility and allowing growers to avoid the stress of brutal price moves and focus on producing world class crops.