Wheat: 11% Protein and 89% Politics

Over the course of the 2022 grain marketing year, we saw extreme volatility in grain markets. It all started in March last year when Russian forces entered Ukraine and hostilities commenced. Three months later a safe grain corridor was negotiated for Ukrainian grain between the UN, Turkey and Russia which was set to expire in November, but was unofficially extended for 120 days. On top of this, the U.S. experienced a drought that decreased their production of wheat. Locally, excessive rainfall due to a trifecta of weather patterns had a severe impact on crop outlooks, particularly for NSW. Nationally, Australian grain was in high demand globally and this is expected to continue into 2023 season.

Conflict in Russia

It was once said that “roughly speaking; wheat is 11% protein and 89% politics”. In no year has this been truer than in 2022. The conflict in Ukraine blocked all ocean freight exports for three months before the Ukraine grain corridor re-opened this pathway at a much-reduced rate. Russia under pressure from the UN, Turkey and other global importers of food faced criticism for the impact this conflict has had on global food security and pricing. They are currently renegotiating the corridor and the market remains uncertain of how this will play out. Following on from this, expectations for plantings of grain in Ukraine for the coming growing season are at 50% of normal. The impact of this conflict will be felt for seasons to come.

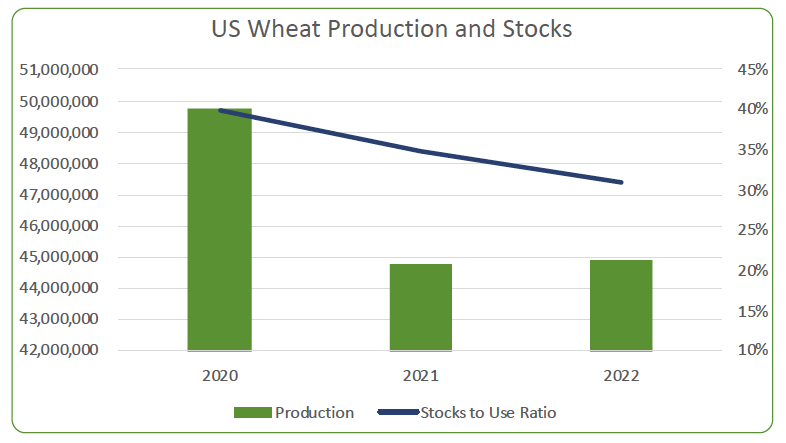

US wheat production suffers through two poor seasons

The effect of the on-going La Nina has been wetter and cooler weather in Australia. However, in North America the impact has been the opposite. Over the course of 2021 both the United States and Canada suffered drought. This season the U.S. recorded its second straight drought affected wheat crop. Production over both seasons is down approximately 10% from the 2020 season which was the last strong production year. The impact is lower stocks and higher prices in the US as they ration demand domestically.

Figure 1 - US wheat Production Stocks

Australia’s East Coast breaks records

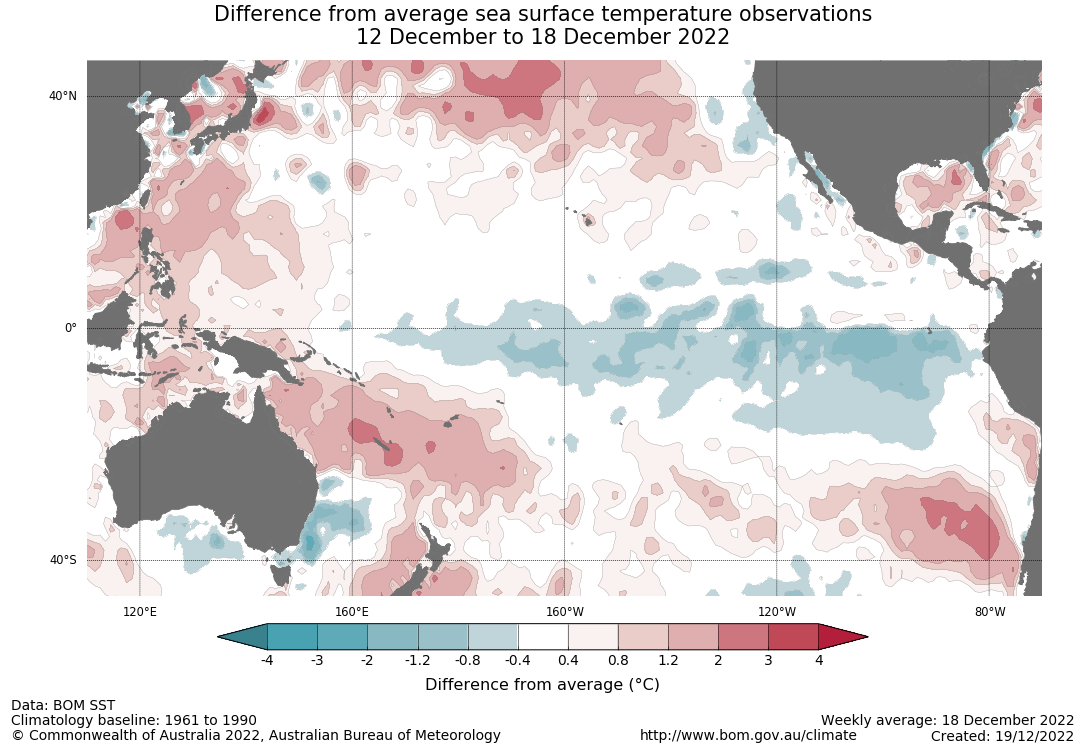

Towns in the Central West of NSW are on track to meet or exceed previous flooding events. Along the Lachlan River towns such as Condobolin and Euabalong have experienced flooding not seen in 70 years. This is due to a trifecta of weather patterns that have aligned to create these extreme wet and cool conditions.

An unlikely third year of La Nina in the Pacific ocean is causing coastal waters off of Australia to warm and the Southern Oscillation Index to contribute to tropical cloud patterns in Eastern Australia.

Figure 2 : Difference from average sea surface temperature observations bom.gov.au

Second, the Indian Ocean Dipole continues to register in a negative phase. This increases the likelihood of weather patterns that swing across Australia from Northwest to Southeast.

Thirdly, the Southern Annular Mode (SAM) is still in a positive state. A positive phase of the SAM shifts westerly winds south of Australia closer to Antarctica. As consequence, we do not experience westerlies that come across inland pushing weather out from the East coast.

It is predicted that all three of these weather phenomena will break down over the coming months.

Over the course of 2022, we saw extreme volatility in grain markets due to the conflict in Ukraine and poor production in the U.S. Presently, there is no end in sight as no talks are being had between Russia and Ukraine. The grain corridor and its effect on grain markets will continue to be volatile as farmers in Ukraine sow less crops as the war takes its toll.

What does it all mean for the coming season?

Overall, Australia is expected to produce a good crop this harvest, albeit a late one. However, certain areas in NSW and VIC have seen crop losses and downgrades due to excessive rainfall.

In these volatile times, the Advantage pooling systems have performed well with solid returns and a low risk approach to grain marketing. With so many external factors, and markets able to change at the drop of a hat, you can never completely predict where prices will head post-harvest. However, looking at the information available, the 2022/23 grain marketing year is shaping up to be a positive one for Aussie growers.

Advantage pooling products are available to growers again in 2022/23 to assist with your post harvest marketing and give you managed exposure to post harvest rallies if they occur. We accept all grades of wheat, barley and canola, have an advanced, monthly and deferred payment option, as well as multiple duration programs to manage your cashflow throughout the year.

The 2, 5 and 10 programs will be closing for transfers on Friday 20th January.

For more information on the pools and how we can help you this season, visit the programs page of our website https://www.advantagegrain.com.au/advantage-programs or call the team on 1300 245 586.