Growers face challenging conditions

17 February 2026

Global grain markets are in the doldrums with high levels of wheat stocks in the world. This is exacerbated by high input costs and an uncertain weather forecast from the Bureau of Meteorology last week. However, there are bright spots. Canola pricing remains strong and Chinese demand for barley is very good. Longer term, there are signals that global producers will be pulling back on production.

World Agricultural Supply and Demand – February 10th, 2026

Last week the USDA updated their supply and demand estimates. It served to reinforce the problematic tale that world wheat stocks are high. Global ending stocks for wheat were estimated at 277.51 million metric tonne (MMT). This is up approximately 20MMT from the prior year and explains the current low global pricing. However, low pricing has incentivised buyers to act. USDA estimated global wheat consumption to also increase for the current year by 22MMT from the prior year. So, people and animals are chewing through the supply.

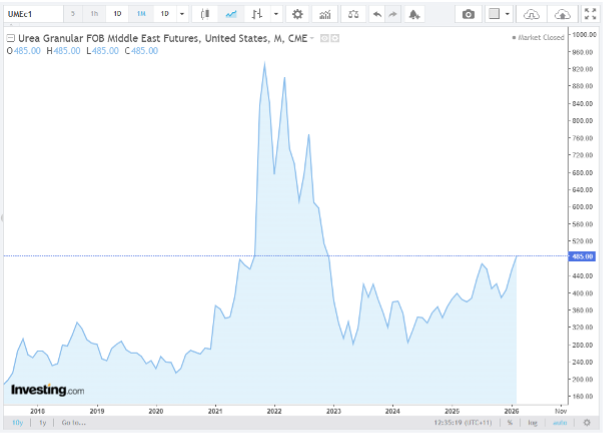

High Input costs are taking their toll on producers

ABARES estimates that input costs for farmers will rise by 5% in 2026. This is across fert, chem, labour, insurance and fuel. In an article dated February 5th, The Weekly Times quoted urea at $800 – 820 a tonne at port. Although down from the COVID-19 highs, it is still much higher than pre-pandemic pricing. Producers are feeling the pinch. As a consequence, large amounts of grain are not coming to market and is instead being sold slowly and in smaller parcels. This isn’t just an Australian phenomenon but a global one. US corn growers have been reluctant sellers as has Black Sea and European producers of wheat.

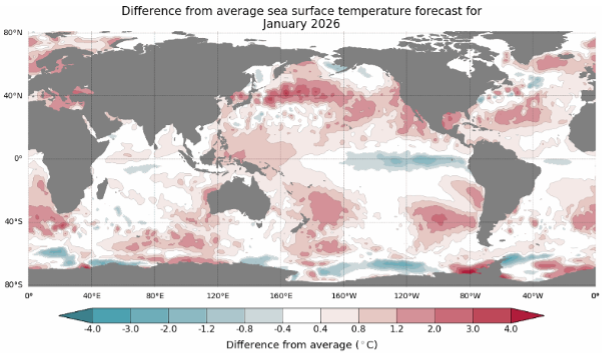

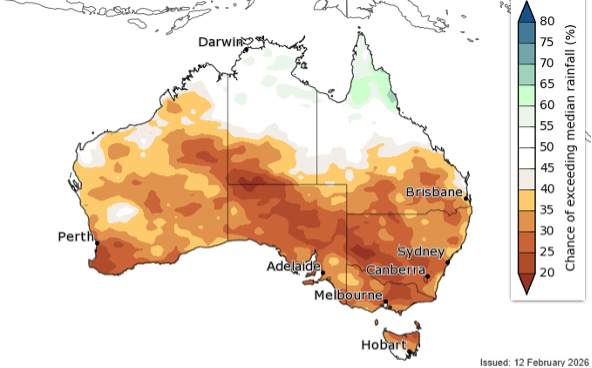

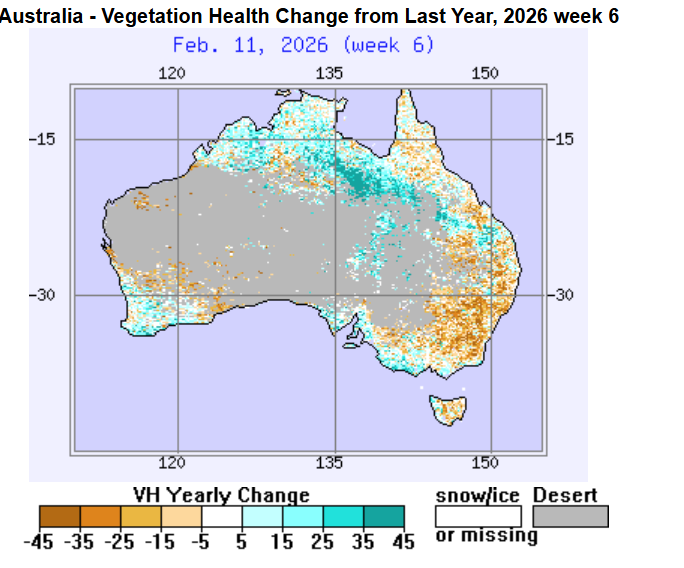

Mother Nature holds the weather cards

The Bureau of Meteorology updated their long-range forecasts on Thursday, February 12th. They stated that “autumn rainfall is likely to be below average for most of the southern two-thirds of Australia”.

This outlook may or may not come to fruition. However, what is known is that current soil moisture levels are well below average for much of New South Wales and Victoria, and rainfall is desperately required to get back on track for planting season. This weather outlook is further reducing producers’ willingness to market grain while we wait for the season to play out.

Canola and Barley are bright spots

Canola is a commodity not currently at multi-year price lows. Strong demand from the European biodiesel industry coupled with hopes for a re-opening of the Chinese markets has supported canola this year. Nationally, the GM variety still carries a large discount as most of Western Australia’s production is now GM varieties. Hopefully, the Chinese market can improve GM pricing over time.

China has been a consistent buyer of Australian feed barley this year. Since November of 2025 there has already been over 4MMT of barley exported by bulk out of Australia. If we include current stem bookings and container exports this number balloons to 6MMT. Good demand with prices close to where ASW1 wheat is trading.

Outlook

As mentioned earlier, there are signs that global seeding will decline this year in the northern hemisphere. Anecdotal reports are that there will be less acreage in the Black Sea and the United States this season. Also, industry reports that forward bookings for fertiliser are dramatically down from this time last year in Europe. All signs point to production declining this year.

As usual, mother nature will have the final say on what global wheat production will be this year… and she can be cruel.