2026 – The Year of the Horse

2 January 2026

Over the course of 2025 we observed a bear trend in market pricing as both Aussie and global production outlooks improved from April through July. The drought in South Australia and to a lesser extent Victoria broke at the same time Russian and US weather improved. Grain markets are now at a soft level not seen since before the pandemic while many inputs and the overall cost of doing business is up. These are challenging times for many producers, but there are bright spots.

As we kick off the new year, let’s take a look at the major weather patterns, what the current predictions are, and how global grain pricing influences are affecting the market outlook for early 2026.

5 La Nina’s in 6 Years

Australia has experienced five La Nina’s in the last six years. This has led to generally wetter conditions across much of the east coast of Australia, albeit with periods of dryness in the southeast of Australia. Although the drought of 2024-25 in South Australia was the state’s worst in 20 years, on the aggregate, Australian winter crop production has been strong over this period.

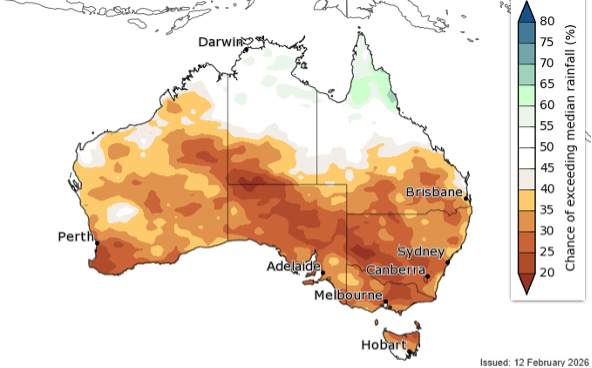

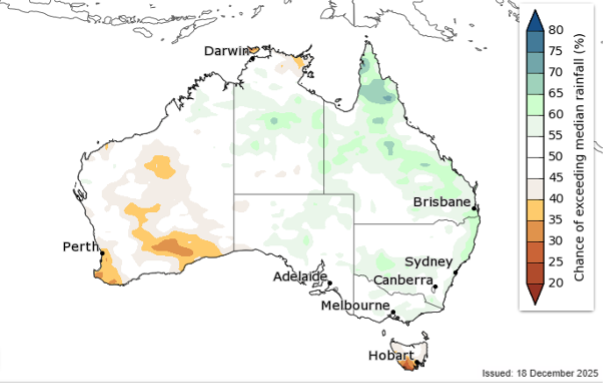

Looking forward, the Bureau of Meteorology forecasts much of Australia to have equal chances of being wetter or dryer than average over January to March 2026. The northern tropical areas could be wetter while there is a risk of dryness in parts of Western Australia. The El Niño Southern Oscillation (ENSO) and Indian Ocean Dipole (IOD) are the primary drivers of this forecast.

El Niño Southern Oscillation (ENSO)

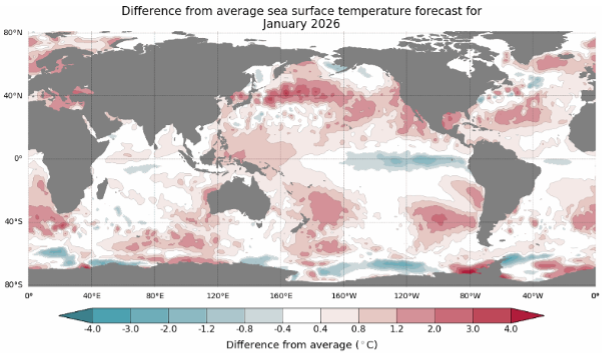

Trade wind strength and cloud patterns have been indicative of La Niña since September 2025 and as of January 1st, weak La Niña conditions remain in place. This is compounded by unusually warm sea surface temperatures to the east of Australia. As a result, January is likely to be wetter than average for northern Australia. In fact, we are already seeing this with flooding in Northern Queensland causing a disaster for impacted graziers. La Niña conditions in the sea surface temperatures are predicted to dissipate over January through March and may trigger a corresponding drop in the probability of higher-than-average rainfall as Australia edges into its 2026 sowing period.

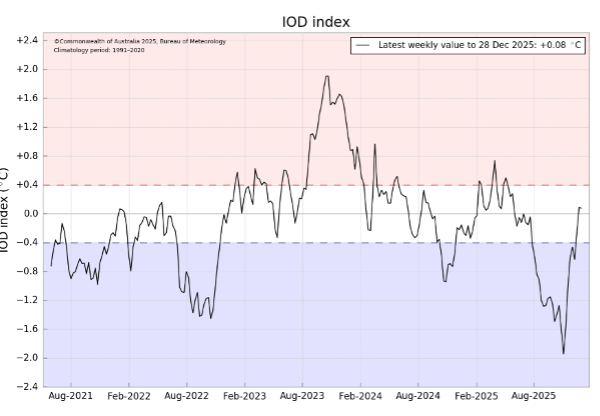

Indian Ocean Dipole (IOD)

The Indian Ocean Dipole measures the difference in sea surface temperatures in the Indian Ocean between the northwest of Western Australia and the waters off the eastern coast of Africa. When warmer waters form on the eastern side of the Indian Ocean, closer to Australia, this is called a negative IOD and increases the chances for weather patterns to sweep across Australia from the west to southeast. The IOD has recently been in a negative phase but has now entered a neutral phase which will decrease the probability of rainfall coming from the west.

Global grain pricing influences

China

The USDA estimates that both corn and wheat are in supply drawdown presently in China, who has been a prolific buyer of Aussie barley this season. We can expect this demand to continue. China has also recently purchased Aussie canola on a test basis. If successful, this renewed market would create support for canola beyond the biodiesel processing markets in Europe. China continues to buy Australian wheat, but the volumes do not surpass normal buying patterns so far. At these levels of commodity price vs cost of production, it is possible we will see China come in for larger purchases of all agricultural commodities for their stockpiles.

Wheat

The global wheat market currently sits in a well-supplied position. However, at current prices it is expected that plantings will decline in 2026 globally. We are already seeing this in Russia with winter wheat plantings down and the USDA estimates American producers to do the same.

Politics

Over the last five years, we have seen a steep increase in global conflict and the war in Ukraine continues into its fourth year. Although the Ukrainians have proven to be resilient and entrepreneurial, this supply chain is under pressure with ongoing drone and rocket attacks. Any further escalation will lead to increased volatility in global wheat markets.

Weather

Over the past 18 months, we have not seen a serious supply disruption in any of the major producing regions globally. In an age of more volatile weather events, we may be overdue. This was after a period between 2021 and 2023 where droughts were suffered in Canada, Kansas, Europe, Argentina and parts of the Black Sea. As usual, mother nature is in charge here and she can be cruel.

Financial volatility and the investor class

During the final months of 2025, we have seen record surges in the price of gold and silver. In the case of gold, it is due to global reserve banks diversifying away from US treasuries. For silver, an increase in demand is expected for usage in data centers. These rallies far exceeded initial estimates when the investor class came into the market. If we were to see production issues in agriculture and/or a sharp jump in demand the same would happen in agriculture markets.

How can Advantage Grain help growers navigate these markets?

The start of a new year is often a time to review and set plans for the year ahead. With weather uncertainty leading into the 2026 sowing period and the predicted ongoing volatility among global grain pricing influences, having structure in your grain marketing approach could provide real benefit to your farming operation.

Advantage Grain offers structured wheat, barley and canola marketing programs that are low cost, low risk and low stress. The programs allow farmers to focus on what they love and do best – farming, while Advantage Grain handles the volatility.

At a time when every dollar counts – it is good to have the Advantage Grain marketing team in your corner.

For assistance with any grain marketing requirements please call your local Advantage Grain representative on the details below.

QLD and NSW: Jack Craig 0474 845 782

SA and VIC: David Long on 0427 012 273 or David Evans on 0437 176 280