Weather and Supply Dominating Grain Market Direction

On Friday, May 12th the USDA updated the world agricultural supply and demand tables. This included the first estimates for the 2023-24 season. Wheat was viewed as bullish as the global carry-out is estimated to fall this coming year. Of note was the decline in U.S. production as drought-hit Kansas is expected to produce the smallest crop in over 50 years. Global production estimates all rely on weather performing over the coming months in key production areas of Russia and Canada for wheat and the United States for corn and soybeans. A tightening wheat balance sheet does not leave room for any further production issues in other major exporters.

U.S. wheat does it tough

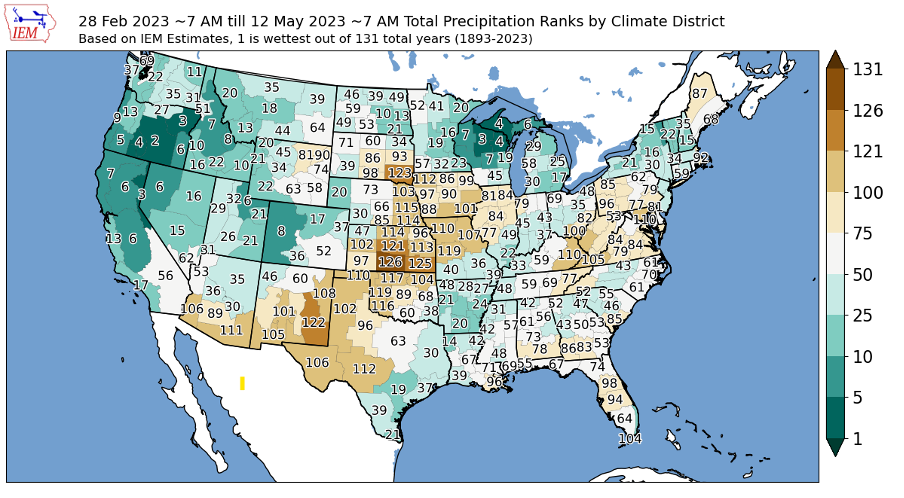

Record abandonment through Kansas, Oklahoma, and Texas has led to this year’s Hard Red Winter crop estimate to be even smaller than 2022’s drought-hit production. However, eastern production of SRW quality has rebounded.

Figure 1 - https://mesonet.agron.iastate.edu/

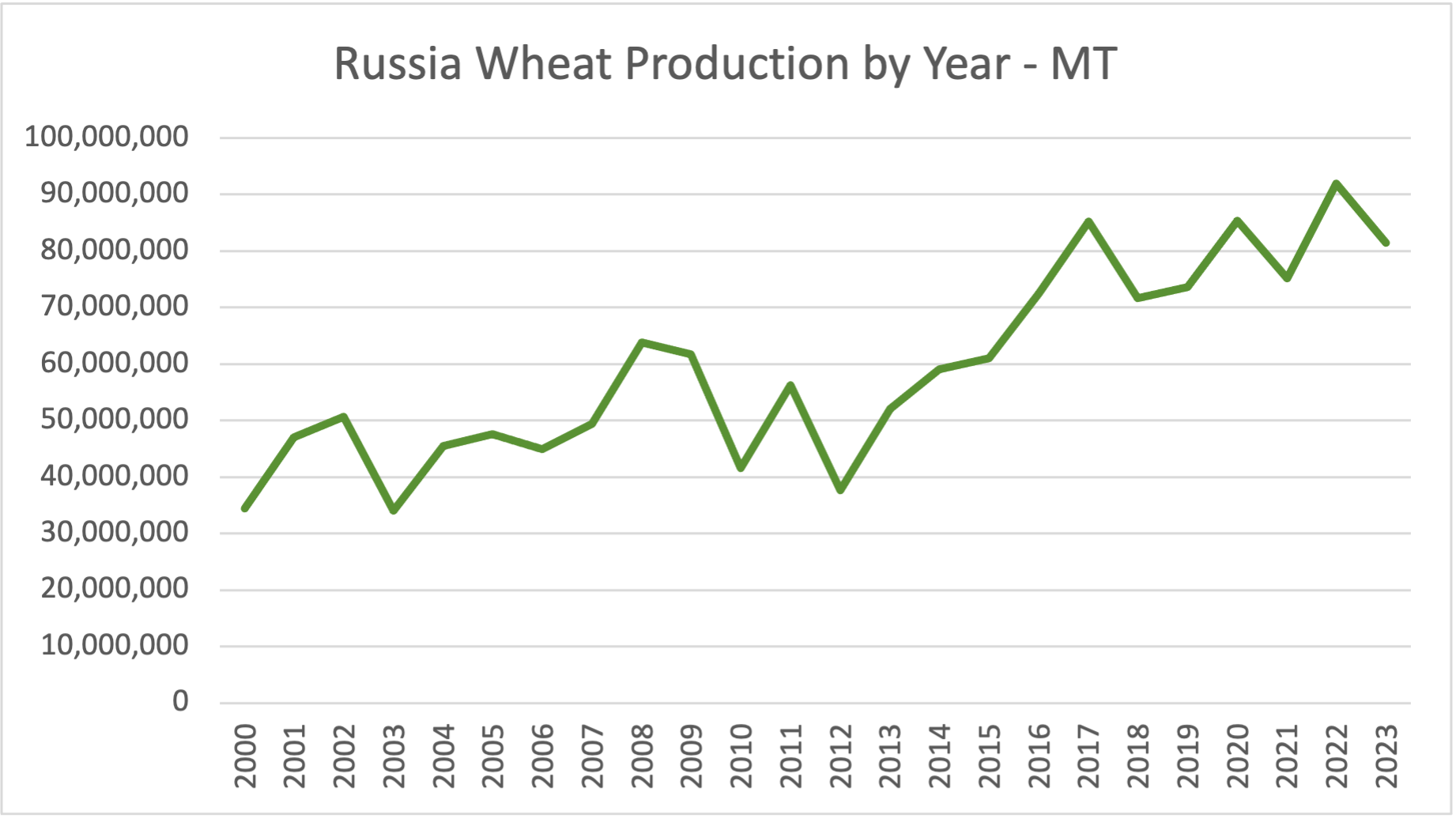

Global importers will switch to other producers such as the EU, Russia, and Australia as U.S. prices remain elevated to ration supply. Right now, the outlook is positive for the EU, but Russia still has some time to go as spring wheat makes up a third of their production and can be impacted over the northern hemisphere summer.

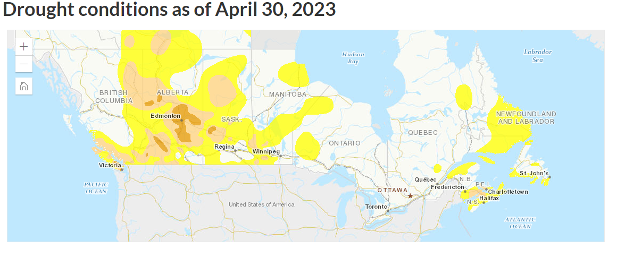

Large parts of Canada through Alberta and Saskatchewan are currently under drought conditions. They will be looking for rain over the coming months to ease these conditions.

Figure 2- https://agriculture.canada.ca

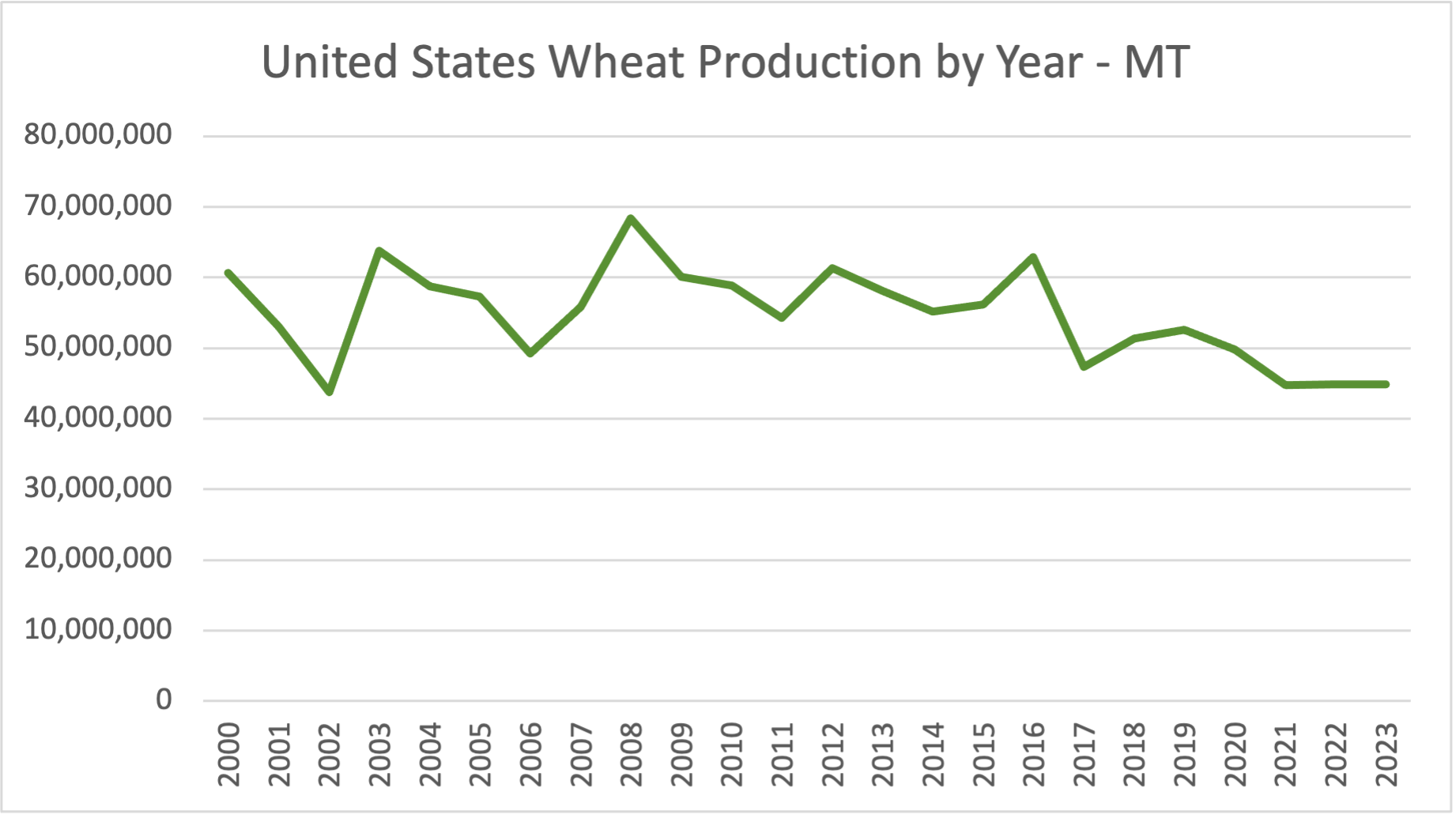

U.S. wheat production has stagnated at the lower end of the range for three years running as drought persists. See figure 3 below.

Concurrently, since 2012 we have seen a trendline increase in Russian production. See figure 4 below.

Figure 3 Annual US wheat production since 2000

Figure 4 Annual Russia wheat production since 2000

If balance sheets are tight, why has the price decreased over the last two months?

In their recent report, the USDA raised the carry out of Russia and the EU by a combined 7MMT for the current season. This was based on reduced domestic demand, reduced exports, and a glut of Ukrainian grain that has been transshipped by road into the EU. This unexpected extra supply entering the markets has impacted wheat and also canola prices as the EU works through this grain. There are also rumours in the market that last season’s Russian crop was larger than the USDA has it. Some say the USDA’s production estimate could be too low by 10MMT. However, this remains unconfirmed.

Although global pricing has deteriorated, demand for Australian grain and oilseeds remains elevated. The Australian Bureau of Statistics reported in March there was 3.73MMT of wheat exported from Australia. This was a new record. They went on to report that a combined 5.1MMT of wheat, barley, and canola was exported. Also, a new record.

What is the global outlook?

A third year of below-average U.S. wheat production has put pressure on global wheat balance sheets. There is no room for any further supply disruptions. Presently, EU crops look good. However, Canada remains under widespread pressure with ‘abnormally dry to moderate drought’ affecting much of the prairies. Also, Russia is unlikely to produce the bin buster they had last season. Closer to home the forecast of an El Nino event raises the uncertainty around our own production and any impact that could have on North America and the EU.

There is a great deal of weather to get through over the coming months including our own in Australia and markets will continue to react accordingly.

Best of luck for the coming production season.

Other articles you may like

Contact Us

We will get back to you as soon as possible

Please try again later

Copyright © 2024 Advantage Grain Pty Ltd

site by mulcahymarketing.com.au