Advantage Grain makes its entrance into Aussie grain export market

Advantage Grain Pty Ltd has announced its entrance into the grain export market, with the company’s first wheat vessel loaded and on its way to the Middle East where it will be used for flour milling.

The Queen Harmony set sail from South Australia’s Thevenard Port on 16 May, filled with 22 thousand tonnes of APW1 quality wheat.

Traditionally a domestic market player, Advantage Grain seized the opportunity to deliver improved returns to its pool customers via the export market this season, with the assistance of export marketing and logistics specialist Basis Commodities.

Advantage Grain General Manager, Chris Nikolaou said the company’s foray into the grain export market marks a significant milestone for the company.

“Advantage Grain has experienced positive growth over the past three years, and we are extremely pleased to have the capacity to generate more value for growers when opportunities such as these arise,” Mr Nikolaou said.

“Generating value for our customers is at the core of everything we do, and adding export to our tool belt when the numbers add up assists us to provide that value.

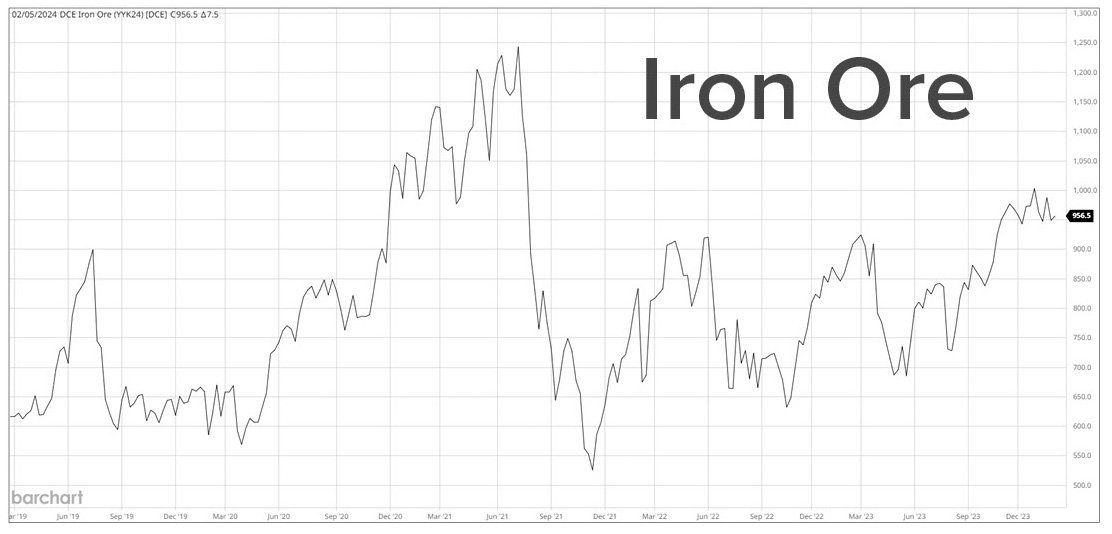

“Moving forward, the ongoing conflict in Ukraine is likely to continue to contribute volatility to global grain markets.

“In this regard, Advantage will continue to pursue the best outcomes for our pool growers in either the domestic or export markets; but only when we are comfortable the risk profile is low.

“Our commitment to low risk selling by averaging out over the course of the season will always be the focus.

“Advantage Grain is very grateful to the grower clients who pool with us, and we look forward to working for them and with them in the seasons to come.”

Advantage has been partnering with farmers to market their wheat, barley and canola since 2008, and has delivered more than four million tonnes of Australian grain into its annual programs during this time.

Over the years the program has evolved to meet changing farmer and market needs, but its core concept of reducing risk by selling an equal portion of grain each month over a set time period has remained constant.

Other articles you may like

Contact Us

We will get back to you as soon as possible

Please try again later

Copyright © 2024 Advantage Grain Pty Ltd

site by mulcahymarketing.com.au