Grain Market Volatility Continues

Grain market volatility continues to be a defining trait of the markets. The Ukraine conflict is ongoing with another round of food corridor extension talks commencing. Over the last six months, drought in Argentina has impacted their wheat and soybean crops and now threatens their corn crop as well. On a more positive note, Australian relations with China are improving and the industry is hopeful for a renewed barley market. Locally, Aussie growers have managed through an extraordinary harvest with extreme weather, a late finish and a slightly better than expected product.

Black Sea Update

February 24, 2023, will mark the one year anniversary of the Russian invasion of Ukraine. The impact on Ukrainian agriculture cannot be understated. Locally, farmers are struggling to access labour, inputs and logistics while also managing through the day-to-day safety concerns of the conflict. It is estimated the winter wheat acreage will be down 40% from last year.

In July of last year, a ‘safe food corridor’ was negotiated with Russia by the United Nations and Turkey for Ukrainian grain exports to continue. The current agreement expires in Mid-March and is being used as an argument to reduce economic sanctions by the Russian authorities.

The short-term impact of this ongoing conflict has been increased price volatility. The long-term impact will be damage done to the Ukraine agriculture industry. In the meantime, Russia is set to export a record wheat program this season. However, it is unlikely their new crop, which is harvested from July, is as big as the current crop.

A tough year in Argentina

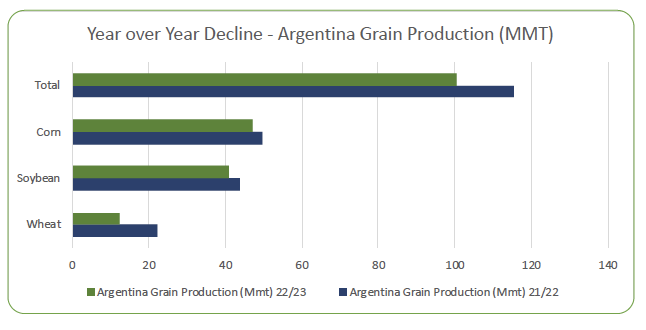

The La Niña weather conditions have been overall kind to Australia, bringing moisture and cool temps to grow above average crops in the areas not impacted by flooding. However, for our neighbors across the Pacific, this weather pattern has been extremely harsh. In the latest USDA report, they have wheat, corn and soybean production down a combined 15MMT. This number is likely to increase over the coming months as the pattern continues to take a toll on unharvested corn and soybeans. The smaller wheat crop has meant more limited competition in Asia for Australian grain.

International Relations with China

In mid-2022, the Deputy Prime Minister and Defence Minister of Australia met with the Chinese Defence Minister at a conference in Singapore. This was the highest-level official meeting between the two countries in three years and was the beginning of what appears to be a thawing in relations. We are beginning to see the impacts in improved trade. A January 10th article in Reuters reports “China’s decision to allow imports of Australian coal after more than two years of an unofficial ban is one of those moves where the symbolic importance outweighs the practical impact”. https://www.reuters.com/markets/commodities/chinas-easing-australian-coal-ban-is-symbolic-not-market-shifting-russell-2023-01-09/.

Locally, grain exporters are hopeful this is indicative of a future relaxation of the barley import tariff which was levied in 2020. Reopening this market would be an excellent result for feed barley growers in Australia.

Australian harvest update

Now that the Australian harvest is complete – let’s take a moment to congratulate our growers on surviving what turned out to be a marathon! Ongoing cool and wet conditions lent itself to a late crop, with a late harvest start and late finish. On a national basis, the crop was good. The most recent USDA report estimated Australian wheat production at 38MMT. If this is true, this would be a new record. However, the conditions were also unkind to some with washouts, disease and missed paddocks a common theme in parts of NSW, VIC and SA. Over harvest, grain markets reacted to a better than expected crop, particularly in January, when the late harvest was going full swing. However, we are now seeing prices improve in the post-harvest period with demand going strong. In particular, the South Australian shipping stem is as well booked as we have seen in many years.

What does this mean for local grain prices?

As we said at the start, grain volatility continues to be the defining trait of the markets. With our local rollercoaster harvest done and dusted, and the Australian crop size known, prices have started to lift from harvest lows. However, as seems to be the norm in recent years, with external factors like the ongoing conflict in the Ukraine, drought ravaging Argentina and easing tensions in China, market volatility is expected to continue.

Advantage Grain has helped many farmers navigate volatile markets over the years. If you’re still holding grain and planning on marketing it throughout the year, we can help. Our March 4 and Flexi programs remain open for transfers. The 4 month program sells a 25% portion of your grain each month from March until June. The Flexi program allows you to choose which months you wish to sell your grain from now until the end of October 2023. Both programs have advance, monthly and deferred payment options.

If you’d like some more information on these programs, visit our programs page or call the team on 1300 245 586.

Other articles you may like

Contact Us

We will get back to you as soon as possible

Please try again later

Copyright © 2024 Advantage Grain Pty Ltd

site by mulcahymarketing.com.au