U.S. Wheat Supply Cuts and The Big Wet

Global wheat markets have surged higher with the U.S. and Black Sea facing production and logistics issues. The conflict in Ukraine, which appears unable to be de-escalate along with expensive U.S. wheat, will ensure strong demand for Australian production. At home, we’re looking at another big winter crop, and although it looks like the La Niña weather pattern will present challenges over harvest, all grades of Aussie wheat look like they’re set to achieve strong values on the global market.

Global Wheat Supply Concerns

U.S. wheat prices have surged of late, disconnecting themselves from the global wheat market. This was spurred on when the USDA unexpectedly reduced the 2022/23 U.S. crop by 133 million bushels or 3.6 million tonnes. The flow on from this is the U.S will ration their wheat for internal use, resulting in the global trade having one less well supplied origin to source grain from.

Australian wheat will predominately compete with Russian, Ukrainian and European supplies for this coming season. Russian exports have flowed steadily throughout September with the Russian grain analyst Sovecon estimating Russia’s September wheat exports at 4.1 MMT. However, concern remains that Russia will not continue to support the Ukrainian Food Corridor deal due to the ongoing war. This agreement is due for review in November. If the deal is cancelled and Black Sea trade flows are hindered in a significant way, Australian supplies will be extremely important to satisfy global demand in a time where the global wheat balance sheet is extremely tight.

When considering only the major wheat exporters, which account for nearly 90% of global trade, Reuters report that wheat stocks-to-use is expected to fall 13.8% in 2022/23. (Karen Braun, Reuters https://www.reuters.com/markets/commodities/outcast-russias-crop-export-success-vital-lean-global-wheat-rations-2022-09-21/) This is the second lowest behind 13.1% in 2007/08 and down from 14.7% in 2021/22. With U.S. exports diminished and further disruptions in the Black Sea likely, Australian growers will have a big part to play in feeding the world in 2023.

Figure 1 : Wheat stocks-to-use in major exporting countries

Wet Weather Challenges

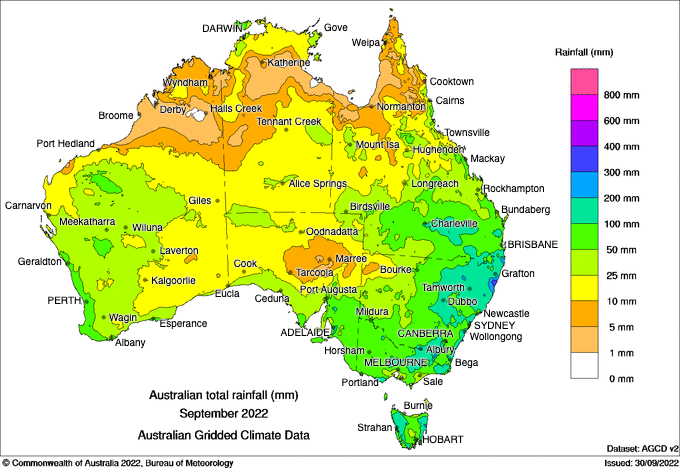

Australian growers love a challenge and the 2022/23 harvest will likely be another huge one! The strong La Niña weather pattern continues to batter Eastern Australia with unrelenting rain hitting cropping areas in the past weeks. Quality and logistics in NSW and parts of Victoria will be challenging with many regions soaked and unable to hold heavy machinery. The season is looking likely to be 3-4 weeks delayed across most of NSW and parts of VIC with crop development slowed by a mild and wet spring. Parts of SA and WA will also be 1-2 weeks late but overall, crop conditions in SA and WA are improving with consistent showers and weather starting to warm.

Figure 2 : September 2022 National Rainfall bom.gov.au

Delays and downgrades are looking likely in NSW. As a consequence, millers have been actively seeking forward commitments of new crop milling wheat. This has proved difficult as they have been met with limited grower engagement as producers wait to see what they have on hand at harvest rather than take on washout risk.

Shipping slots for 2023 have been snapped up at record pace across the country, with capacity in most port zones sold out until September. Lower quality Australian wheat prices were relatively well supported by global prices during the 2021/22 marketing year. If there is a silver lining to the excessive wet, this coming season should also be a great opportunity for all grades of Australian wheat to achieve strong values on the global market.

With so many external factors, and markets able to change at the drop of a hat, you can never completely predict where prices will head post harvest. However, looking at the information available, the 2022/23 grain marketing year is shaping up to be a positive one for Aussie growers. Reserving a portion of your grain to be marketed throughout 2023 could provide significant benefit. Advantage pooling products will be available to growers again in 2022/23 to assist with your post harvest marketing and give you managed exposure to post harvest rallies if they occur. We accept all grades of wheat, barley and canola, have an advanced, monthly and deferred payment option, as well as multiple duration programs to manage your cashflow throughout the year. For more information on the pools and how we can help you this season, visit the website advantagegrain.com.au or call the team on 1300 245 586.

Other articles you may like

Contact Us

We will get back to you as soon as possible

Please try again later

Copyright © 2024 Advantage Grain Pty Ltd

site by mulcahymarketing.com.au