Italians Raise Concern For Penne Pasta and Risotto Rice Dishes.

An ongoing strong La Niña has led to wetter than normal conditions in Australia and dryer than average conditions in the United States and the growing regions of South America. Western Europe is also struggling with dry and hot conditions. Australian exports continue at a strong pace while the market switches focus to the outlook for new crop locally.

La Niña roars on

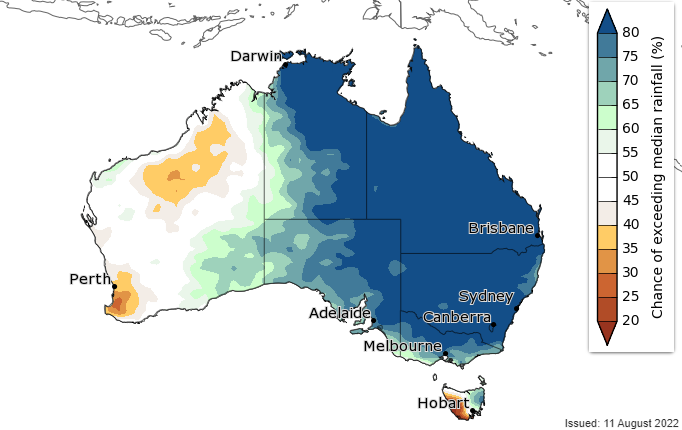

In their August 11th update the Bureau of Meteorology predicted a wetter than average spring rainfall for the eastern and southern parts of Australia. They went on to state that a “negative Indian Ocean Dipole event, warmer than average waters around northern Australia and a neutral to cool phase of the El Niño – Southern Oscillation are influencing this outlook”.

Figure 1 Chance of exceeding media rainfall BOM http://www.bom.gov.au/

The impacts of this weather phenomenon have been felt in the southern states of the U.S. where Texas has recorded one of its driest years in 130 years of data records. Oklahoma, Kansas and Nebraska have also been doing it tough with crop ratings for corn and soybeans falling in recent weeks.

Across the pond in Europe, the Rhine River levels in France are so low that commercial shipping has been impacted. Cnn.com reports in an article dated August 14th that 63% of the UK and EU are in either drought warning or alert status.

This drought has impacted EU summer corn production severely. The USDA reduced European corn production this month by 8MMT to 60MMT. Local observers say this number should reduce further.

In Italy, durum wheat and summer rice production have been cut by the poor conditions. The local Italian ag reporting agency Coldiretti reports that wheat and rice yields have dropped by 30%. Farmer associations are calling for government assistance with Coldiretti agency president Ettore Prandini stating “it is necessary to intervene immediately with emergency measures to save crops...and farms that are in serious difficulty”.

Argentina continues to experience hot and dry conditions. The August 11th USDA report reduced wheat production by 500KMT on account of the poor growing conditions. This is 3.5MMT lower than last season and it is expected that Argentina will be a much-reduced exporter this season.

Local conditions improve but many doing it tough in NSW

Over the recent month, growing conditions have improved in many areas of the country. Much of WA, western SA and Victoria are seeing improved conditions for their crops. However, many crops in SA are late and there are areas in eastern SA that have not see adequate rainfall. Also, excessive rainfall in NSW continues to cause havoc. A full profile does not have the ability to absorb ongoing rainfall leading to damaging run-off and large areas that were never planted. It is estimated that 10 - 15% of acres were either not planted or have been washed out. This excessive rainfall is also making a difficult supply chain more challenging with anecdotal reports of difficulties getting truck access to on-farm grain.

The USDA report on August 11th called for an Australian wheat crop of 33MMT for the coming season. This would be an excellent outcome, if achieved. However, we are more circumspect. Over the coming months there remains many weather risks to overcome. Best of luck this spring for a kind finish to the season.

Other articles you may like

Contact Us

We will get back to you as soon as possible

Please try again later

Copyright © 2024 Advantage Grain Pty Ltd

site by mulcahymarketing.com.au