International relations improve the barley outlook

“In view of the changes in China’s barley market, it is no longer necessary to continue to impose anti-dumping duties and countervailing duties on imported barely from Australia” This was the statement from the Chinese Ministry of Commerce on Friday, August 4th which opened the market back up for Australian barley.

Background

In 2020, Chinese authorities instituted an 80.5% import tariff on all Australian barley. A tax of this size halted barley imports overnight and Australia was left with the loss of its largest barley customer. The charge at the time was that Australia was ‘dumping’ barley into China at below the domestic Australian price. The grain of truth in this argument was domestic barley prices in Queensland were in fact higher, but this was due to the region slowly exiting a prolonged drought. Barley prices in the export focused states of Western Australia and South Australia were, in fact, much lower. At the time, many viewed it as retribution for the Australian government at the time taking an international lead to demand more information on the origins of covid-19.

Trade

China was the largest buyer of Australian malt and feed barley in the years preceding the tariff. The loss of this market over the last three years has brought more traditional buyers such as Saudi Arabia and Japan back in as larger customers. This is a good thing and should support Australian malt and feed barley exports going forward.

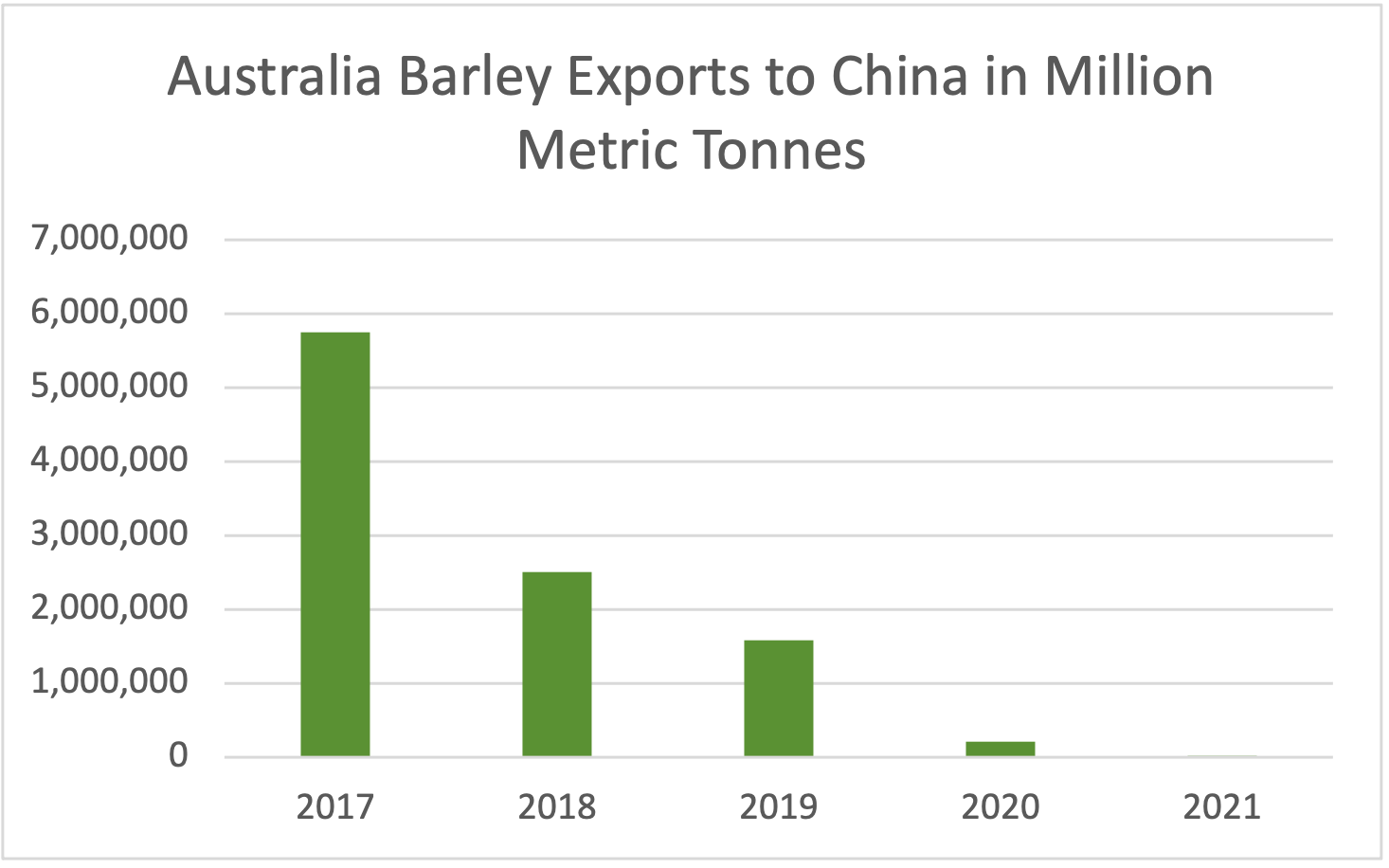

The graph below shows China imported nearly six million metric tonnes (MMT) of barley in 2017. However, this number dropped during the two drought affected production years of 2018 and 2019. Then drops to zero by 2021, which was the first full year the tarrif was in effect.

Figure 1 - ABARES

WASDE

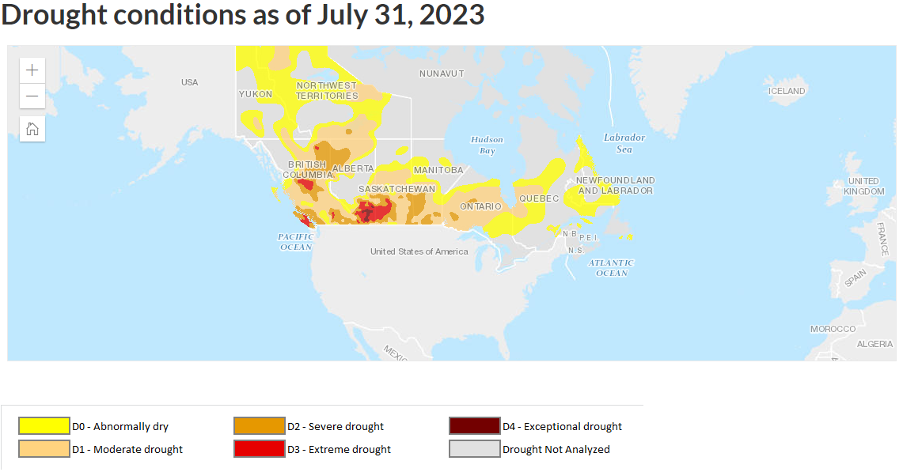

On Friday August 11th, the USDA updated their monthly World Agricultural Supply and Demand report. Overall, the report was bearish corn, neutral in wheat and supportive to soybeans. Their assessment of canola was dominated by a 1.3MMT decrease in Canadian production. This reflects the ongoing drought conditions afflicting central Canada. This reduced total production to 19MMT which would be the same as last year. With increased domestic consumption in the crush, Canada’s ending stocks were decreased by 265 thousand metric tonne (KMT) for this season. Australia’s production forecast was left unchanged at 4.9MMT.

Figure 2- www.agriculture.canda.ca

Black Sea Update

On July 17th, Russia announced they would no longer participate in the Ukraine safe food corridor that had been brokered one year earlier by Turkey and the United Nations. The deal consisted of a narrow trade route that could be operated by merchant vessels for the bulk export of grains and oilseeds from the deepwater ports around the city of Odessa. Over the last 12 months, this route had accounted for approximately 2.5MMT of grain and oilseed exports per month. At the time of writing, no bulk exports had left through this route since the deal was closed last month. This puts more pressure on other logistics through neighboring countries or into continental Europe. However, the sea battle is now escalating with Ukraine using a maritime drone to attack a Russian oil tanker last week. This week, Russia responded by firing on a merchant vessel attempting to leave Odessa and then boarding the vessel. For now, the conflict will continue to impact the grain and oilseed markets as there seems to be no end to the hostilities in sight.

Figure 3 - www.aljazeera.com

Summary

We applaud the Chinese government for taking the common-sense approach to cancel the tariff and we look forward to servicing their market once again. This will be a benefit to both Australian producers and Chinese consumers (they love our malt for beer!). Unfortunately, the conflict in the Black Sea region is now ratcheting up to take on a navel face as well, which adds risk to not only the Ukrainian but also Russian bulk ocean exports.

The USDA reported that the US looks to survive a tough and volatile season with trend production, but Canada is suffering the impacts with lower expected production. Global weather and geo-political uncertainty look set to continue for the foreseeable future as we prepare to focus on the business end of the production season with a rain-dance.

Best of luck to everyone this coming spring.

Other articles you may like

Contact Us

We will get back to you as soon as possible

Please try again later

Copyright © 2024 Advantage Grain Pty Ltd

site by mulcahymarketing.com.au