China wheat demand outpaces expectations as Australian harvest progresses

The 2022/23 marketing season has now come to a close.

Overall, the Advantage structured marketing programs have performed well through what was a volatile season. Ongoing war in the Black Sea, a tough finish to the U.S. corn crop and poor rainfall late in the Australian season all led to a late-season spike in local grain prices. Growers in the Advantage 10 month program benefited from this in the September – October pricing period.

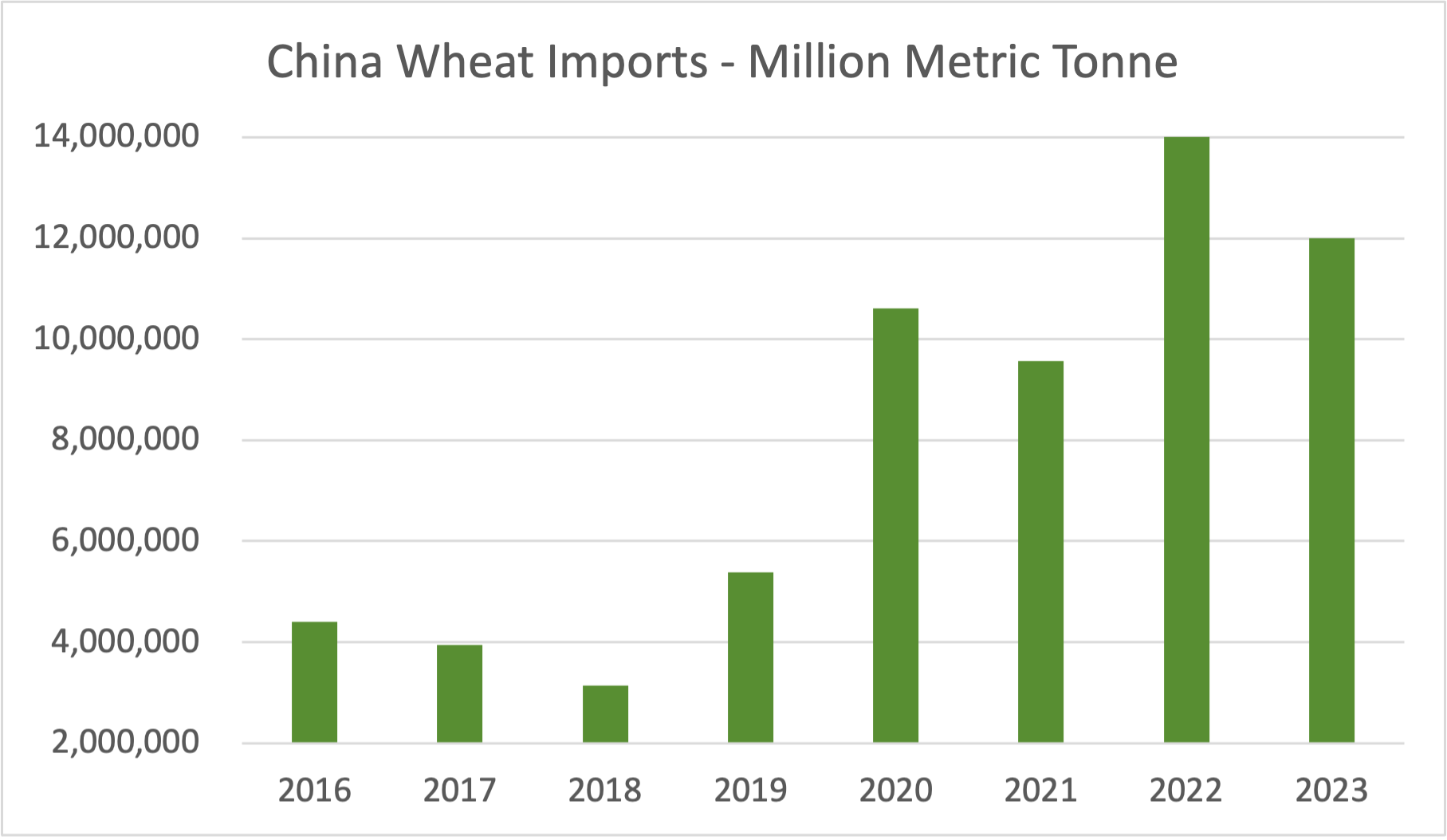

As expected, China has re-entered the market as a strong buyer of Australian barley since the import tariffs have been lifted. China also continues to buy Australian wheat at a pace that is not as sustainable as the purchases during recent higher production years.

The canola market is still down from the start of the season but a recent uptick in pricing may suggest a turnaround is on the cards for the overall oilseeds markets.

Figure 1 - Large increase in Chinese wheat imports in recent years

Australian production outlook for the 2023/24 season

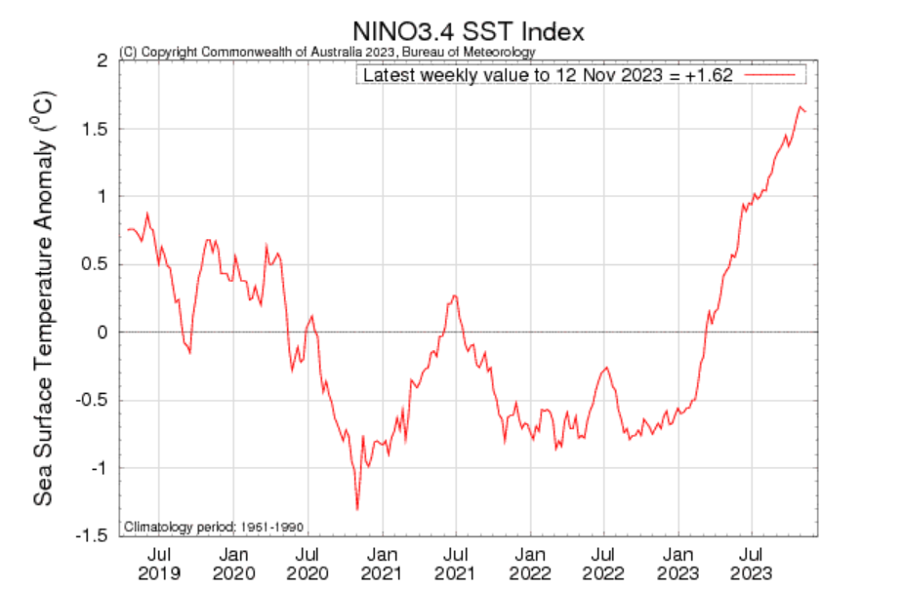

After prolonged talk of a potential El Niño, measurements finally triggered the BOM to declare the weather pattern in late winter. Since that time, the index sea surface temperature rose aggressively over August – October of this year. An Index measure of 0.8 indicates an El Niño weather pattern.

Figure 2- www.bom.gov.au

The impact of this weather pattern on finishing rains for the East Coast and South Australian growers was unfortunate. What was a strong first half of the growing season gave way to decreasing rainfall.

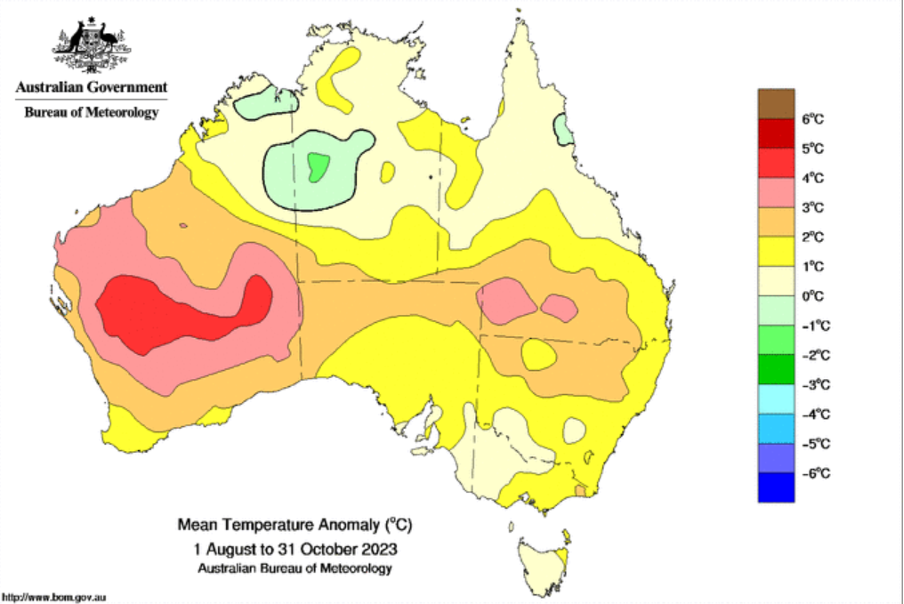

Figure 3 - www.bom.gov.au

The saving grace for producers was a lack of associated extreme heat. The graphic below shows that apart from Northern WA, most of the growing crescent was able to get through without extreme heatwaves as the crops finished off in September and October.

Figure 4 - www.bom.gov.au

Most analysts now view the national wheat production in the vicinity of 25 million metric tonne (MMT). This is well down on recent years but above the drought affected production years of 2017 – 2019 which dipped to 14.5MMT in 2019.

A good customer is a good friend!

China has returned as a buyer of Australian barley as they enter their third year of strong Australian wheat purchases. Since the import tariff was dropped, barley prices have rallied by over $40 AUD/MT which shows the importance of this market for Australia. In the meantime, China has been a continued buyer of Australian wheat. Last season their focus was on ASW1 from WA but this season they have shown a strong appetite for APW1 quality which is currently being sourced from all Australian states. Some estimate they may have already purchased over 3.5MMT with continued buying to do. With production well down on last season, this is not an inconsequential amount of purchases.

Could the tide be turning for oilseeds?

2023 was a challenging year for canola producers. A glut of Ukrainian oilseeds traveling over land into the EU impacted our largest and highest-priced buyer of Australian canola. This along with a better than anticipated rapeseed season in Canada weighed on values all year.

However, oilseeds may prove to be resilient in 2024.

Presently, Brazil is battling with excessive hot and dry weather in the north and flooding rains in the south of the country. They are now at the stage where yields and final plantings will start to be compromised. If this weather pattern continues all oilseed prices will benefit from the decline in their production.

Palm oil pricing is expected to rebound in 2024. Aging palm trees in Indonesia and Malaysia are experiencing a decline in yield prospects. This will assist canola and its by-products as substitutes.

Also, Europe is slowly working through the glut of Ukrainian oilseed and is expected to rebound their canola imports this coming year.

What does this mean for Aussie growers as we move into harvest and the new marketing year?

The 2022/23 grain marketing year was a volatile one with plenty of curve balls that required active participation in the markets to garner the best returns. This type of grain volatility is becoming more and more common with ongoing geopolitical tensions and extreme weather influencing markets.

The Advantage structured grain marketing program has helped growers navigate volatile markets in a low-risk and stress-free manner since 2008. Australian grain production is down on last season but there is continued strong demand for wheat and barley from China that will help support pricing. War continues to impact the Black Sea supply chain and there are threats to production in Brazil presently.

For a low-risk and stress-free grain marketing option to navigate these markets, please call Advantage Grain on 1300 245 586.

Other articles you may like

Contact Us

We will get back to you as soon as possible

Please try again later

Copyright © 2024 Advantage Grain Pty Ltd

site by mulcahymarketing.com.au